Health Insurance Premiums Are Rising Faster Than Income

In every budget, we can control what we pay for some items while others are out of our control. Health insurance premiums are one of those items over which the consumer has little or no control (outside of raising the deductible or changing to an inferior plan). In this article, we’ll look at the rise in health insurance premiums from 2005 to 2014 and compare it to personal income.

In a recent article, I explained how health care inflation has been rising at a greater pace than overall inflation (CPI). (To read it, CLICK HERE). When health insurance premiums rise faster than income, it requires more of a person’s budget to pay the bill. When more of our income is needed to pay the premium, we have less to spend.

Health Insurance Premiums and Personal Income: A Brief History

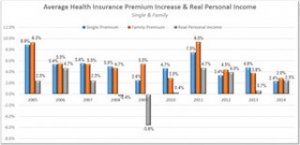

The following chart contains the annual increase for health insurance premiums and real personal income. As you can see, in 2005, premiums rose by 8.9% for a single person and 9.3% for an average family. That same year, personal income rose by a mere 2.5%. Therefore, it took about 6.5% more of one’s income to pay the premium. In 2009, the situation was worse as personal income declined by 5.6% and premiums rose by 2.6% to 5.5% compared to the year before. The average family lost a lot of ground that year as the gap was over 11%. Each year that health insurance premiums rise faster than income, there is less money to save or spend. As a result, families may take fewer vacations or save less for retirement. Obviously, this was an issue that needed to be addressed. Then, on March 23, 2010, the President signed the Affordable Care Act into law. One of the goals of the Act was to reduce the cost of health care, including premiums. However, as you can see, in 2011 health care premiums rose by a staggering 9.5% for an average family and 7.5% for an individual.

Notice how personal income rose by 4.7% in 2011 and 4.0% in 2012. Why? Most likely because Congress reduced the Social Security payroll tax from 6.2% to 4.2% for 2011-12. In 2013, the tax reverted back to 6.2% and personal income rose by a paltry 0.7%.

Rising Health Insurance Premiums

Why have premiums risen so much? There are several reasons. One of them is that the government has mandated that every policy must cover the 10 essential health benefits. As a result, insurance companies no longer operate in a free-market system. Because every policy covers the same items, there is very little flexibility or opportunity for innovation. In other words, insurers cannot tailor a policy like they could in the past. Hence, all policies are basically the same. In an Obamacare-compliant policy, the only variables are the co-insurance and deductible. The percentage of health care expenses covered ranges from 60% in a bronze plan, to 90% in a platinum plan.

The new law is not perfect, but neither was the former system. Under the current law, a single male seeking coverage must pay for maternity coverage because it is one of the 10 essential benefits. This is the case despite the fact that a single male will never utilize the benefit.

If you think premiums are high now, just wait. According to several health insurance agents I’ve heard from, there will be a large increase in premiums in 2016. I hope they’re wrong. As I stated, the old system and the current one are flawed. For example, under the former system, millions of Americans were without coverage and, if you had a pre-existing condition, you might have been uninsurable. Today, you cannot be turned down due to a previous or existing health condition. However, there are some policies today that require applicants to meet certain minimum health standards to obtain coverage. These plans typically fall under one of the exemptions of the new law.

What Can Be Done?

Typically, when you remove competition from an industry, the result is higher prices and a reduction in quality. We’ve all heard the horror stories about people having to wait a long time for critical treatment in countries with universal health care. I fear this could easily happen in the U.S.

What can we do to fix this? We need to foster competition among insurers. We also need to allow insurers to create customized policies where the consumer can select the type and degree of coverage they want from a list of broad categories. We also need to eliminate the state boundaries (a part of the former system) and allow insurance companies to sell across state lines. With this, there would need to be some degree of federal regulation that would shift some of the power from individual states. Generally, I favor states powers but, in this case, a coordinated effort between the federal government and each state could be beneficial. The last item on my short list is the political influence. When insurance companies and related PACs make large donations to a particular candidate, and this person is elected, reciprocation is often expected. Unfortunately, that’s politics. However, it’s often the consumer who loses. As premiums continue to rise faster than incomes (although in 2014 the gap narrowed considerably), only time will tell if the dire predictions made by many will materialize.

Can our health care system be fixed or at least improved? I believe it can. If we decrease the federal government’s role, allow for competition, and make a few additional changes, we may be able to create a solution that provides the best possible coverage at a fair price. Then, everybody wins, except those who have been benefiting politically.

Source: Forbes