First Year After Launch – Special Feature

Not your father’s launches

The leading members of the pharmaceutical industry’s new compound class of 2013 have set a new standard for launch success.

Remember when a drug that generated $100 million in sales in its first full year on the market was cause for wonder and surprise? Or, more recently, when a drug stunned the industry with $1 billion in sales in less than 12 months on the market?

To the top members of the launch class of 2013, that’s ancient history. Three new compounds that completed their first full year on the market in 2014 rolled up more than $2 billion in sales apiece that year. And one of those three generated more than $10 billion, with a follow-on already tracking to beat that number by a considerable margin in 2015.

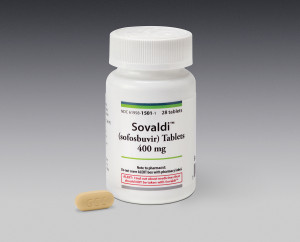

Sovaldi

Setting a new land-speed record for pharmaceutical launches in 2014, Gilead’s hepatitis C drug Sovaldi went from zero to 11 figures in revenue practically before the ink was dry on its first FDA indication. Approved by the agency at the end of 2013, the product rolled up an extraordinary $10.28 billion in sales for 2014, transforming Gilead’s financials in the process; the company’s top line for the year more than doubled to $24.89 billion while its stock price rose by more than a quarter.

The Sovaldi train is continuing to speed along in 2015 as well; while the solo product generated just (!) $2.26 billion in first half 2015 sales, its combination follow-on Harvoni registered $7.19 billion in sales for the same period after its own approval in October 2014.

In December 2013, FDA approved Sovaldi 400 milligram tablets for the treatment of chronic hepatitis C infection as a component of a combination antiviral treatment regimen. The new drug’s efficacy had been established in subjects with hepatitis C virus genotypes 1, 2, 3, or 4 infection, including those with hepatocellular carcinoma meeting Milan criteria (awaiting liver transplantation) and those with HCV/HIV-1 co-infection. U.S. regulators had already granted Sovaldi Priority Review and Breakthrough Therapy designations.

“It is our hope that Sovaldi will mark the beginning of a new era in hepatitis C treatment,” said John C. Martin, Ph.D., chairman and CEO of Gilead, in the approval announcement. “Gilead is proud to have played a role in bringing about this important therapeutic advance and we would like to extend our thanks to the many patients and physicians who partnered with us on Sovaldi’s clinical studies.”

Chronic hepatitis C affects an estimated 4 million people in the United States, the majority of whom are “baby boomers” – individuals born between 1945 and 1965. The disease is the nation’s leading cause of liver cancer and liver transplantation, and in recent years has surpassed HIV/AIDS as a cause of death. The prior standard of care for HCV involved up to 48 weeks of therapy with a pegylated interferon (peg-IFN)/ribavirin (RBV)-containing regimen, which may not suitable for certain types of patients. The Sovaldi treatment regimen can decrease this time frame to as little as 12 weeks.

Sovaldi’s approval was supported primarily by data from four Phase III studies which evaluated 12 or 16 weeks of treatment with Sovaldi combined with either RBV or RBV plus peg-IFN. In these studies, Sovaldi-based therapy was found to be superior to historical controls or to placebo, or non-inferior to currently available treatment options based on the proportion of patients who had a sustained virologic response (HCV undetectable) 12 weeks after completing therapy (SVR12). Patients who achieve SVR12 are considered cured of HCV. Trial participants taking Sovaldi-based therapy achieved SVR12 rates of 50 to 90 percent.

During FDA’s review, data from two additional Phase III studies were added to the NDA as a result of the Breakthrough Designation status. In the first study, patients with genotype 3 HCV infection were treated with Sovaldi and RBV for 24 weeks. Eighty-four percent of patients in this trial achieved SVR12.

The other study evaluated Sovaldi and RBV for 12 weeks in patients with genotype 2 HCV infection co-infected with HIV-1 and for 24 weeks in patients with genotypes 1 or 3 HCV co-infected with HIV-1. Trial participants achieved SVR12 rates of 76 to 92 percent. In all Phase III studies of Sovaldi, no viral resistance to the drug was detected among patients who relapsed following completion of therapy.

Other regulatory health authorities were quick to follow FDA’s example. By the end of 2014, Sovaldi had been approved in more than 40 countries and been used to treat more than 170,000 patients. But by then Gilead had already launched Harvoni, a combination of Sovaldi with the developmental compound ledipasvir. After gaining approval from FDA last October, Harvoni became the first once-daily single tablet regimen for the treatment of chronic hepatitis C genotype 1 infection in adults, and shortened the potential treatment time for patients by a third, down to just eight weeks.

Harvoni’s approval was supported by data from three Phase III studies evaluating eight, 12, or 24 weeks of treatment with or without ribavirin among nearly 2,000 genotype 1 HCV patients with compensated liver disease. These studies included non-cirrhotic treatment-naïve patients, cirrhotic and non-cirrhotic treatment-naïve patients, and cirrhotic and non-cirrhotic patients who failed prior therapy with an interferon-based regimen, including regimens containing an HCV protease inhibitor. The primary endpoint for each study was SVR12. Trial participants in the ribavirin-free arms (n=863) achieved SVR12 rates of 94 to 99 percent.

“Unlike other serious chronic diseases, hepatitis C can be cured and Harvoni offers patients the potential for a cure in as little as eight weeks,” Dr. Martin says. “Gilead is proud to have played a role in developing a once-daily therapy that is safe, simple and well tolerated. We are now working to ensure rapid and broad access to Harvoni.”

So far, so good; combined sales of Sovaldi and Harvoni in first-half 2015 were the largest for any prescription compound in any half-year in history – in fact, their combined sales nearly matched Sovaldi’s for all of 2014.

Tecfidera

In second place among the rookie class of 2013 is Biogen’s Tecfidera. The multiple sclerosis drug earned its parent company sales of $2.91 billion in 2014, rapidly becoming the No. 1 prescribed oral MS therapy in the United States and the No. 1 overall MS therapy in Germany in less than a year. Helped by this newly found revenue, Biogen’s top line for the year jumped an even 40 percent to $9.7 billion.

In March 2013 FDA approved Tecfidera as a new first-line oral treatment for people with relapsing forms of multiple sclerosis. The new compound had been clinically proven to significantly reduce important measures of disease activity, including relapses and development of brain lesions, as well as to slow disability progression over time, while demonstrating a favorable safety and tolerability profile.

“With the FDA approval of Tecfidera, we will offer the MS community a treatment with strong efficacy and a favorable safety profile in the convenience of a pill – a combination we believe will have a significant positive impact on the way people live with this chronic disease,” said George A. Scangos, Ph.D., CEO of Biogen. “We believe Tecfidera will raise expectations for what people living with MS can achieve with their therapy.”

The FDA approval of Tecfidera was based on data from a clinical development program that included DEFINE and CONFIRM, two global Phase III studies that enrolled more than 2,600 patients. In the ongoing extension study, ENDORSE, some patients receiving Tecfidera have been followed for more than four years.

In DEFINE, Tecfidera, administered twice daily, significantly reduced the proportion of patients who relapsed by 49 percent, the annualized relapse rate by 53 percent, and 12-week confirmed disability progression, as measured by the Expanded Disability Status Scale, by 38 percent compared to placebo at two years. In CONFIRM, twice-daily Tecfidera significantly reduced ARR by 44 percent and the proportion of patients who relapsed by 34 percent compared to placebo at two years. Both studies also showed that Tecfidera significantly reduced lesions in the brain compared to placebo, as measured by magnetic resonance imaging.

Helping to drive Tecfidera sales along, in April 2014 a post-hoc analysis from DEFINE and CONFIRM reinforced that Tecfidera can be effective in RRMS patients with high disease activity. In addition, new data from the Phase IV MANAGE study showed that gastrointestinal events experienced by patients in the clinical practice setting were mostly mild to moderate and generally manageable, and significantly decreased in prevalence within the first two months of treatment.

In the first quarter of 2015, though, Tecfidera sales were down about 10 percent to $825 million as compared with 4Q14. Company leaders blamed this in part on having one fewer shipping week in the quarter and increased discounts; a U.S. label update in December after the reported progressive multifocal leukoencephalopathy-related death of a patient on Tecfidera also influenced sales. Additionally, the August 2014 launch of another new Biogen MS product, Plegridy, has put a brake on Tecfidera’s growth; company leaders report that Plegridy has captured some interferon switches that otherwise may have gone to Tecfidera. In the second quarter of 2015, Tecfidera sales rebounded a bit, rising 7 percent to $883 million.

Olysio

Apparently one of the keys to success for new compounds approved in 2013 was to be indicated for the treatment of hepatitis C. Not quite as spectacular as Sovaldi/Harvoni but still impressive in its own right, Janssen’s new drug for that disease, Olysio/Sovriad, earned more than $2.3 billion in its first full calendar year on the market.

In November 2013, FDA approved Olysio, an NS3/4A protease inhibitor, for the treatment of chronic hepatitis C infection as part of an antiviral treatment regimen in combination with pegylated interferon and ribavirin in genotype 1 infected adults with compensated liver disease, including cirrhosis. The drug works by blocking the viral protease enzyme that enables the hepatitis C virus to replicate in host cells.

Janssen’s NDA for Olysio was based in part on efficacy and safety results from three pivotal Phase III studies – QUEST-1 and QUEST-2 in treatment-naïve patients and PROMISE in patients who have relapsed after prior interferon-based treatment – as well as data from the Phase IIb ASPIRE study in prior non-responder patients. Each of the studies evaluated Olysio dosed once daily in combination with pegylated interferon and ribavirin versus treatment with placebo plus pegylated interferon and ribavirin.

Results from a pooled analysis of QUEST-1 and QUEST-2 demonstrated that 80 percent of treatment-naïve patients in the group receiving Olysio achieved sustained virologic response 12 weeks after the end of treatment (SVR12), compared with 50 percent of patients in the placebo groups. In PROMISE, 79 percent of prior-relapser patients in the simeprevir group of the study achieved SVR12 compared with 37 percent of patients in the placebo group. Results from ASPIRE demonstrated that use of Olysio led to sustained virologic response 24 weeks after the end of treatment (SVR24) in 65 percent of prior partial-responder patients and 53 percent of prior-null responder patients compared with 9 percent and 19 percent of prior partial- and null-responder patients in the placebo groups, respectively.

In the QUEST-1 and QUEST-2 studies, among genotype 1a treatment-naïve patients receiving Olysio who had the Q80K polymorphism (a naturally occurring variation in the HCV NS3/4A protease enzyme), 58 percent achieved SVR12 versus 84 percent of patients without the Q80K polymorphism. In the placebo arm, 52 percent of patients with the Q80K polymorphism achieved SVR12. In the PROMISE study, among prior-relapser patients with the Q80K polymorphism who received Olysio, 47 percent achieved SVR12 versus 78 percent of patients without the polymorphism. In the placebo arm, 30 percent of patients with the Q80K polymorphism achieved SVR12.

Unfortunately for Janssen, the company’s researchers did not have a follow-on waiting in the wings quite as quickly as Gilead’s did, and so Olysio’s sales began to fall off in late 2014 when Harvoni was approved. In the first half of 2015, Olysio/Sovriad’s sales dropped by more than half, to $498 million. Janssen earned an additional approval for the drug in combination with Sovaldi in November. Data supporting the combination regimen came from the COSMOS study, an open-label, randomized Phase II clinical trial that investigated the efficacy and safety of 12 or 24 weeks of Olysio in combination with Sovaldi with or without ribavirin in HCV genotype 1 chronically infected treatment-naïve and treatment-experienced adult patients with compensated liver disease. For all patients in the COSMOS trial, 93 percent achieved SVR12 after 12 weeks and 97 percent achieved SVR12 after 24 weeks of treatment. Viral relapse occurred in 7 percent of patients after 12 weeks and no patients after 24 weeks of treatment overall.

“We’re pleased that an interferon-free, ribavirin-free Olysio-based combination is now approved in the United States for patients with genotype 1 chronic hepatitis C infection,” says Gaston Picchio, Ph.D., hepatitis disease area leader, Janssen Research & Development LLC. “The availability of multiple treatment options is important to help offer an opportunity for cure and we believe Olysio will play a meaningful role in this respect. We’re passionate about finding new treatment options for patients living with hepatitis C worldwide and will continue to pursue innovative approaches to help address this disease.”

Kadcyla

Another trend among the successful members of pharma’s Class of 2013 is the strength of biologics; Roche’s breast cancer product Kadcyla is the fourth biologic ranked at the top of the entire class. While not matching some of the spectacular numbers of its higher-ranked classmates out of the gate, the product generated about $586 million in sales last year, helped by a clear improvement in progression-free survival shown in its clinical studies. And unlike those previous products, Kadcyla’s growth has continued into the new year, with sales up 65 percent in the first half of 2015.

Kadcyla was approved by FDA in February 2013 for the treatment of patients with HER2-positive metastatic breast cancer (mBC) who have received prior treatment with Herceptin (trastuzumab) and a taxane chemotherapy. The product is an antibody-drug conjugate, a new kind of targeted cancer medicine that can attach to certain types of cancer cells and deliver chemotherapy directly to them. Kadcyla is the first FDA-approved ADC for treating HER2-positive mBC, an aggressive form of the disease.

“Kadcyla is an antibody-drug conjugate representing a completely new way to treat HER2-positive metastatic breast cancer, and it helped people in the EMILIA study live nearly six months longer,” said Hal Barron, M.D., Roche’s (now former) chief medical officer and head, global product development, in the approval announcement. “We currently have more than 25 antibody-drug conjugates in our pipeline and hope this promising approach will help us deliver more medicines to fight other cancers in the future.”

Kadcyla is made up of the antibody trastuzumab and the chemotherapy DM1, joined together using a stable linker. The product combines the mechanisms of action of both trastuzumab and DM1; it is the first Roche ADC approved by FDA. Roche has studied ADC science for more than a decade and has eight ADCs in Phase I or Phase II studies for different types of cancer.

The FDA approval of Kadcyla was based on results from EMILIA (TDM4370g/BO21977), an international, Phase III, randomized, open-label study comparing Kadcyla alone to lapatinib in combination with Roche’s Xeloda (capecitabine) in 991 people with HER2-positive locally advanced breast cancer or mBC who had previously been treated with Herceptin and a taxane chemotherapy. The study met both co-primary efficacy endpoints of overall survival and progression-free survival (PFS; as assessed by an independent review committee). People who received Kadcyla lived a median of 5.8 months longer (overall survival) than those who received the combination of lapatinib and Xeloda, the standard of care in this setting (median overall survival: 30.9 months vs. 25.1 months). People receiving Kadcyla experienced a 32 percent reduction in the risk of dying compared to people who received lapatinib and Xeloda. Also, people who received Kadcyla lived significantly longer without their disease getting worse (PFS) compared to those who received lapatinib plus Xeloda.

But not all the Kadcyla news has been positive. Roche’s leaders were hoping that a combination of Kadcyla with another Roche breast cancer product, Perjeta, would prove superior to the combination of Herceptin and chemotherapy. It didn’t turn out that way, though; in December, the results of the Phase III MARIANNE study showed that neither Kadcyla alone or Kadcyla and Perjeta significantly improved PFS compared with Herceptin/chemo.

“In this study, we had hoped to show improvement in progression-free survival without the use of traditional chemotherapy in the first line treatment of patients with advanced HER2-positive breast cancer,” says Sandra Horning, M.D., Roche’s chief medical officer and head of global product development. “While MARIANNE didn’t achieve this result, we will continue to study these medicines, as well as investigational treatments for other types of breast cancer, with the goal of improving outcomes for patients.”

Pomalyst

An outlier among the industry’s most successful 2013 launches – not a biologic, and not even really a new compound at all – is Celgene’s multiple myeloma drug Pomalyst. While the cancer indication is new, the story of Pomalyst goes back a long way; it is a derivative of thalidomide, the infamous morning sickness medication that caused thousands of cases of birth defects in Europe in the late 1950s but was blocked from approval in the United States by FDA staff member Dr. Frances Oldham Kelsey, inspiring the creation of the agency’s modern regulatory powers by Congress.

Celgene’s revival of the compound behind what may have been the 20th century’s most notorious pharmaceutical disaster is showing that even drugs sometimes deserve a second chance. Launched in early 2013, Pomalyst/Imnovid generated $305 million in sales for the rest of that year, $679.7 million more in 2014, and $433 million in the first half of 2015, a 46 percent improvement over 1H14.

FDA approved Pomalyst in February 2013 for patients with multiple myeloma who have received at least two prior therapies including lenalidomide and bortezomib and have demonstrated disease progression on or within 60 days of completion of the last therapy.

Supporting the approval were the results of MM-002, a Phase II, randomized, open-label study evaluating Pomalyst (4 milligrams once daily on days 1-21 of each 28-day cycle) plus low-dose dexamethasone (40 mg per day given only on days 1, 8, 15 and 22 of each 28-day cycle for patients 75 years or younger, or 20 milligrams per day given only on days 1, 8, 15 and 22 of each 28-day cycle for patients greater than 75 years of age) versus Pomalyst (4 mg once daily on days 1-21 of each 28-day cycle) alone in patients with relapsed multiple myeloma who were refractory to their last myeloma therapy and had received lenalidomide and bortezomib. Of the 221 patients that were evaluable for response, 29.2 percent achieved a partial response or better in the pomalidomide plus low-dose dexamethasone arm compared to 7.4 percent in the pomalidomide-alone arm.

This past April, Celgene announced that it had fulfilled the accelerated approval requirements for Pomalyst based on results from MM-003, an international Phase III study of the drug plus low-dose dexamethasone versus high-dose dexamethasone in relapsed/refractory multiple myeloma patients. In the MM-003 study, median progression-free survival, the primary endpoint of the study, was significantly longer with Pomalyst plus low-dose dexamethasone (3.6 months) than high-dose dexamethasone (1.8 months). Patients in the Pomalyst plus low-dexamethasone arm had a 55 percent reduction in the risk of progression or death.

“There remains a significant unmet need for relapsed/refractory multiple myeloma patients,” says Jacqualyn A. Fouse, Ph.D., president, global hematology and oncology for Celgene. “Pomalyst has been able to help thousands of patients since its approval in 2013 and this data now confirms its survival benefits. This label update provides important information about a key product in our industry-leading portfolio of therapies for patients with multiple myeloma.”

=========================

A new playbook

We spoke with Ken Begasse, Jr., founder and CEO of Category III Agency of the Year Concentric Health Experience, about the impact of pharma’s launch class of 2013 on the marketer’s role

Med Ad News: Several of the top-performing new drugs of 2013 have followed a new pattern – unlike the Lipitors of the past, which generated major sales year after year, they rolled up massive sales in their first year only to fall off when “replaced” with a follow-on. How might this sort of life cycle impact the relationships between pharma companies and their partner marketing agencies?

Ken Begasse, Jr.: Well, from my perspective, it means you see a lot more franchise level opportunities, right? So I think the reality of the situation is for our clients, it’s about establishing a relationship with their customers on a company level with any specialty and a focus in developing a long-term relationship with that customer from – let’s say, with the actual organization as opposed to the brand. The innovation and the discovery pipeline is so rich that they’re able to build those long-term relationships with the customer during introduction of all these new products. So for me, what you see is an opportunity for more of a relationship on the franchise rather than just the brand level.

Companies will want an agency with a robust strategy department that is not just about brand strategy but is focusing on pushing that commercial strategy, enhancing the clinical strategy, and having a strong sense of the customer, all the dynamics at play. So you are looking broader and further and deeper and looking at how our client’s organization can partner with their customers. In this situation a single brand becomes secondary, because it’s just a tool as opposed to the basis for the relationship.

So we as an agency, what we are seeing is while we are working to help make initial launch successful or commercialization of a product successful, we are quickly having parts of our organization partnering with our clients at a higher level to be positioned in the next two or three products down the line. It also means that life cycle management of that product is taken into consideration. So when we are looking at promoting a product and launching the product right into a commercial space, we’re taking into consideration that there are another two or three products down the line and ensuring that we are doing what’s great for the brand and market today but not threatening the value proposition of those brands coming down the pipeline.

Med Ad News: Given the higher stakes inherent in a shorter marketable timeframe, do you foresee the agency world fragmenting into disease specialty areas – i.e., this is the hep C agency, that is the MS agency, etc.?

Ken Begasse, Jr.: Well, I think you’re always going to see some of that reaction to a marketplace dynamic with agencies. I think you saw it in oncology early on, when certain agencies were becoming known as the oncology agencies. Some of them overtly position themselves as the oncology agency. Some of them grew to have strong oncology capabilities over time. There are two factors that changed that. One is, quite honestly, conflict – how clients view potential brand conflicts in your roster. So having an agency with experience in a marketplace – if you’re looking for that type of experience, that can limit who you could talk to because there are only going to be a few agencies that might have that, or if they do have that experience, they could be conflicted out.

So there will ultimately always be enough opportunities for agencies to work in these spaces because of conflict. The other thing is, we believe wholeheartedly, sometimes using an agency that has a diverse experience, institutional experience in multiple categories, sometimes is the best – it gives you the best perspective, an insight into a marketplace because they’re able to take and translate experience in problem-solving, in situational knowledge from one marketplace to the other that helps accelerate our immersion process and our ability to make sense on what we are seeing in the market. That might not be seen by an agency who is 100 percent focused in that one market.

We see similarities from one marketplace to another, from one brand challenge to another. Sometimes, we apply those. We apply those as a baseline assumption into what we are seeing, and that allows us to come up with more innovative ideas to solve the challenge for our clients. So experience is always important, but I think when you start working with agencies that have experienced people and then you have agencies that have a strong strategic process and infrastructure, you can quickly onboard agencies into different marketplaces pretty quickly.

Med Ad News: Has the rapid success of Sovaldi and its kin changed expectations for launches industry-wide? Or are folks thinking, “Well, hep C is an unusual case, that shouldn’t change our expectations for my diabetes product”?

Ken Begasse, Jr.: Well, to be honest, I think that it kind of resuscitated the market in general. The pharmaceutical industry itself is in a resurgence within the investment community, and I think that it has a lot to do with the success that some of the newer entrants into the market are having. I think it’s primarily because these are great products that are coming to market that are truly differentiated. They have truly incorporated clinical, practical, and emotional value propositions that have solved problems within those specialties. What I do think is, what it does is it opens up our client’s eyes to say, “What can we do with the more robust strategy, launch strategy?” We start to do things that these other products have done. Can they apply to my marketplace? So they start thinking a little bit bigger.

If you think of these markets, you think of these products, these products are utilizing – not only are they great products but they are utilizing a lot of innovative channel mixing. They are utilizing strong branding, strong connection to the customer. That requires a robust marketing plan. I think a lot of brands in the past limited the amount of things that they did because they felt that the market couldn’t bear it. But what we’re seeing is that, “Hey, maybe I can apply some of that learning in some of that success that you’re seeing in the other brands to my plan,” which is great for us and the agency because I think ultimately, we’re always so excited to be asked, “What could you do if you had the next $10 million? What could you do to drive this business to this particular goal?” Let’s take out all of the constraints of our current assumptions and start thinking bigger. I think that’s what we are seeing.

Med Ad News: What did you see in the campaign for Sovaldi that separated it from the pack?

Ken Begasse, Jr.: They did great brand awareness. They did great pre-launch brand awareness initiatives and they utilized capacity and mix of both YouTube online, utilizing digital online as well as going through the broadcast. The other thing is that, 30 days prior to launch, they basically had all their customers. They had an RM or program infrastructure that basically allowed them to have instantaneous access at launch to customers who are waiting for a product. They were able to build that kind of confidence and that trust between the customer, between the patient and the organization, as well as the physician through years of value-added messaging, value-added content, and then they were able to basically activate that at launch.

Med Ad News: But is that a repeatable concept in other disease areas?

Ken Begasse, Jr.: Well, I think certain organizations have that ability. One of the benefits for Gilead is they already had an HIV franchise, right? If you have products on market or within a general area, you can start to establish those relationships and you expect to move patients from one to another more efficiently. If you also know that what’s behind you is a pipeline that’s strong and that you’re going to be in the marketplace for a considerable amount of time in a leadership position, then you can feel comfortable bridging the innovations gap through that kind of customer relationship because you’re not spending money against a relationship or investing in relationships that ultimately might go somewhere else because you don’t have a product. So it has a lot to do with whether an organization has products on market. Right now, relate the current relationship and then match it with what their pipeline looks like so that they’re confident that how they are investing will translate to brand use both today and in the future.

I think it’s finally the shift from being brand-focused to customer-focused. When you’re brand-focused, every line item has to be attributed to an ROI on the brand. When you think about customer-centric, you are really focused on return on engagement. You are making sure that I’m having a relevant and meaningful engagement with my customer because once I establish a relationship with the customer, that customer’s value is much greater than the value of one prescription on a brand, of one particular brand.