Johnson & Johnson 2019: Operation Pharma Growth

Johnson & Johnson management has outlined a strategy to deliver above-market, compound annual growth for the company’s pharmaceutical business through 2023.

Johnson & Johnson

One Johnson & Johnson Plaza

New Brunswick, NJ 08933

Telephone: 732-524-0400

Website: jnj.com

Best-Selling Rx Products

| Product | 2018 Sales | 2017 Sales |

|---|---|---|

| Remicade |

$5,326 |

$6,315 |

|

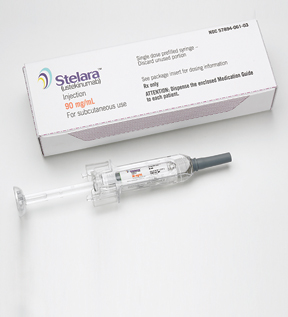

Stelara |

$5,156 | $4,011 |

|

Zytiga/abiraterone acetate |

$3,498 |

$2,505 |

|

Invega Sustenna/ |

$2,928 |

$2,569 |

| Imbruvica |

$2,615 |

$1,893 |

| Xarelto | $2,477 | $2,500 |

| Simponi, Simponi Aria | $2,084 | $1,833 |

|

Darzalex |

$2,025 |

$1,242 |

|

Prezista, Prezcobix/Rezolsta, Symtuza |

$1,955 |

$1,821 |

| Opsumit | $1,215 | $573 |

| Velcade |

$1,116 |

$1,114 |

| Procrit/Eprex |

$988 |

$972 |

| Invokana, Invokamet |

$881 |

$1,111 |

| Edurant/rilpivirine |

$816 |

$714 |

| Risperdal Consta |

$737 |

$805 |

| Concerta/methylphenidate | $663 |

$791 |

| Uptravi |

$663 |

$263 |

| Tracleer | $546 | $403 |

| Tremfya | $544 | $63 |

All sales are in millions of dollars.

Financial Performance

| 2018 | 2017 | |

|---|---|---|

| Revenue |

$81,581 |

$76,450 |

| Net income |

$15,297 |

$1,300 |

| Diluted EPS |

$5.61 |

$0.47 |

| R&D expense |

$10,775 |

$10,554 |

| 1H 2019 | 1H 2018 | |

|---|---|---|

| Revenue |

$40,583 |

$40,839 |

| Net income |

$9,356 |

$8,321 |

| Diluted EPS |

$3.47 |

$3.05 |

| R&D expense |

$5,524 |

$5,043 |

All sales are in millions of dollars except

earnings per share.

Outcomes Creativity Index Score: 57

Manny Awards – 2

Cannes Lions – 18

LIA: Health & Wellness – N/A

Clio Health – N/A

One Show: HW&P – 3

MM&M Awards – 5

Global Awards – 9

Creative Floor Awards – 20

Johnson & Johnson is dedicated to delivering breakthrough medicines to meet the needs of patients around the globe. The company features a robust pipeline that leverages data science, advanced therapeutic modalities including cell and gene therapy, and a parallel focus on diseases and biological pathways. J&J has implemented a strategy to continue to drive a robust pipeline of innovative medicines to generate near-term and long-term, volume-driven growth.

Johnson & Johnson’s Janssen Pharmaceutical Companies outlined a strategy in May to deliver above-market, compound annual growth through 2023. Janssen plans to maximize the potential of the company’s leading brands by filing more than 40 line extensions for regulatory approval through 2023. Janssen intends to file for regulatory approval or launch at least 10 new medicines between 2019-2023.

“We delivered solid second-quarter (2019) underlying sales growth and strong earnings growth that enables us to make investments in innovation to accelerate performance in each of our businesses. Our pipelines continue to progress with the launch of new products and several regulatory submissions and approvals, which positions us well to deliver the next wave of transformational products and solutions. I am proud of our talented colleagues across Johnson & Johnson who continue to deliver significant healthcare advances to improve the lives of patients and consumers around the world,” says Chairman & CEO Alex Gorsky.

J&J is committed to delivering a competitive and increasing dividend, having paid $9.5 billion in dividends to shareholders during 2018, and will continue to deploy capital to value-creating acquisitions with more than $5 billion dollars invested in acquisitions across the company in recent months. Johnson & Johnson is concentrated on returning capital to shareholders via share repurchases and has completed more than one-third of the company’s $5 billion authorization announced during 2018 as of March 2019. Together with the company’s significant free cash flow and strong balance sheet, management intends to execute all levers of J&J’s capital allocation strategy to fund future growth opportunities while providing attractive returns to shareholders.

A growth opportunity was seized by Johnson & Johnson’s Ethicon Inc. during February via a deal to acquire Auris Health Inc. for $3.4 billion in cash. Additional contingent payments of up to $2.35 billion, in the aggregate, may be payable upon reaching certain predetermined milestones according to J&J. Auris Health is a privately held developer of robotic technologies, initially concentrated in lung cancer, with an FDA-cleared platform used in bronchoscopic diagnostic and therapeutic procedures. This acquisition will accelerate J&J’s entry into robotics with potential for growth and expansion into other interventional applications. The transaction was completed on April 1.

2019 Performance & Outlook

Global sales for J&J during the first six months of 2019 amounted to $40.6 billion, representing a year-over-year total decrease of 0.6 percent, including operational growth of 2.7 percent. According to the company, currency fluctuations had a negative impact of 3.3 percent for the first half of 2019. The net impact of acquisitions and divestitures on worldwide operational sales growth during January-June 2019 was a negative 1.9 percent.

J&J U.S. companies generated sales of $20.5 billion, which represented a 0.3 percent decrease versus the first-half 2018 performance. Net impact of acquisitions and divestitures on the U.S. operational sales growth was a negative 1.8 percent year-over-year. J&J international companies were down 1.0 percent to $20.1 billion versus the same-time 2018 period, including operational growth of 5.8 percent, offset by a negative currency impact of 6.8 percent. First-half 2019 net impact of acquisitions and divestitures on the international operational sales growth was reported as a negative 1.9 percent.

Johnson & Johnson’s Europe companies experienced a 2.8 percent decline in growth for the first six months of 2019, which included operational growth of 4.6 percent offset by a negative currency impact of 7.4 percent. Sales by non-U.S. companies in the Western Hemisphere produced a sales decline of 4.8 percent that included operational growth of 6.5 percent, offset by a negative currency impact of 11.3 percent. Sales by companies in the Asia-Pacific, Africa region achieved growth of 2.9 percent compared to the first-half 2018 period, including 7 percent operational growth and a negative currency impact of 4.1 percent.

The blockbuster brand Stelara is marketed for treating various immune-mediated inflammatory diseases. J&J’s immunology products achieved operational growth of 11.5 percent during first-half 2018 compared to the same period one year earlier, Stelara overtook Remicade during first-half 2019 to become J&J’s top-selling medicine with sales of $2.96 billion.

Pharmaceutical segment sales during first-half 2019 rose 2.8 percent to $20.8 billion compared to same-time 2018, with an operational increase of 6.1 percent and a negative currency impact of 3.3 percent. U.S. Pharmaceutical sales grew 1.0 percent versus the performance produced during January-June 2018. International Pharmaceutical sales advanced 5.2 percent during the first six months of 2019, including operational growth of 12.5 percent and a negative currency impact of 7.3 percent. The net impact of acquisitions and divestitures on the Pharmaceutical segment operational sales growth was negligible, according to the company.

Sales for the Medical Devices segment during January-June 2019 fell to $12.9 billion, representing a 5.7 percent decline, with an operational decline of 2.6 percent and a negative currency impact of 3.1 percent. U.S. Medical Devices sales dropped off 3.6 percent versus the first six months of 2018. International Medical Devices sales in first-half 2019 were down 7.6 percent, including an operational decline of 1.6 percent and a negative currency impact of 6.0 percent. J&J reported that the net impact of acquisitions and divestitures on the Medical Devices segment operational sales growth was a negative 6.4 percent of which, the divestitures of LifeScan and ASP had an impact of 5.1 percent and 1.1 percent.

Consumer segment sales during the 2019 first half totaled $6.9 billion, resulting in a year-over-year decline 0.6 percent, including operational growth of 3.4 percent and a negative currency impact of 4.0 percent. First-half 2019 U.S. Consumer segment sales rose 2.2 percent. International Consumer segment sales declined 2.6 percent compared to 2018’s first six months, including an operational increase of 4.3 percent and a negative currency impact of 6.9 percent. Net impact of acquisitions and divestitures on the Consumer segment operational sales growth for first-half 2019 improved 1.9 percent.

In announcing the company’s first-half 2019 performance, J&J increased operational sales guidance for the full year to $82.4-$83.2 billion due to strength of business. The guidance range for the company’s adjusted operational earnings per share on a diluted basis for full-year 2019 was maintained at $8.73 to $8.83.

Pharma Product Approvals/Launches and Pipeline Updates In 2019

During 2019, Janssen has gained U.S. regulatory clearance for two first-in-class molecular entities, Spravato (esketamine) nasal spray for treatment-resistant depression in adults and Balversa (erdafitinib) for treating adults with bladder cancer that has spread or cannot be removed surgically.

Spravato CIII nasal spray was approved by U.S. regulators during March for use in conjunction with an oral antidepressant in adults with treatment-resistant depression (TRD). Spravato uses the first new mechanism of action in decades for major depressive disorder. In short-term and long-term studies, patients who received the nasal spray and a newly initiated oral antidepressant achieved superior improvement in depression symptoms, and sustained improvement in their symptoms over time versus adults who received a placebo and an oral antidepressant.

Janssen unveiled positive results during September from two pivotal Phase III clinical trials (ASPIRE I & II) to assess the efficacy and safety of esketamine nasal spray in addition to comprehensive standard of care (SOC) in adults with major depressive disorder who have active suicidal ideation with intent. The double-blind, randomized, placebo-controlled, multicenter trials met their respective primary efficacy endpoint, which was a reduction in depressive symptoms at 24 hours after the first dose, as measured by the Montgomery-Åsberg Depression Rating Scale. J&J says the global clinical program is the first to evaluate this severely ill patient population, who are typically excluded from antidepressant treatment studies.

Esketamine is a non-selective, non-competitive antagonist of the N-methyl-D-aspartate (NMDA) receptor, which is an ionotropic glutamate receptor. With a novel mechanism of action, esketamine works differently than currently available therapies for major depressive disorder. Esketamine nasal spray in conjunction with a newly initiated antidepressant is FDA-approved for treatment-resistant depression (TRD) and has been submitted for Health Authorities review for TRD in other markets around the world, including Europe.

Janssen’s Balversa in April became the first fibroblast growth factor receptor (FGFR) kinase inhibitor to receive U.S. FDA marketing clearance. The new medicine was approved for treating patients with locally advanced or metastatic urothelial carcinoma (mUC) with certain FGFR genetic alterations. The approval follows FDA Breakthrough Therapy Designation awarded during March 2018 and Priority Review Designation of the New Drug Application filed in September 2018.

Balversa won U.S. marketing clearance during April 2019 as the first targeted therapy for the treatment of advanced bladder cancer.

Once-daily, oral Balversa is indicated for the treatment of adults with locally advanced or mUC which has susceptible FGFR3 or FGFR2 genetic alterations and who have progressed during or following at least one line of prior platinum-containing chemotherapy, including within 12 months of neoadjuvant or adjuvant platinum-containing chemotherapy. The FDA simultaneously cleared for marketing a companion diagnostic for use with Balversa. Qiagen N.V.’s therascreen FGFR RGQ Reverse-transcription (RT)-polymerase chain reaction (PCR) Kit is the first PCR-based companion diagnostic approved to detect FGFR alterations. The therascreen FGFR test detects the presence of FGFR alterations in the tumor tissue of mUC patients.

The FDA granted marketing clearance during August for a label expansion for Sirturo (bedaquiline) tablets. Sirturo was approved by the FDA as part of combination therapy in pediatric patients – those older than 12 years and younger than 18 and weighing at least 66 pounds (30 kilograms) – with pulmonary multidrug-resistant tuberculosis (MDR-TB), when an effective treatment regimen cannot otherwise be provided.

Cleared under the FDA’s accelerated approval pathway based on time to sputum culture conversion, bedaquiline can now be used as part of combination therapy for eligible MDR-TB patients aged 12 years and older in the United States.

The FDA approval marks the first regulatory milestone as part of J&J’s global pediatric research and development (R&D) program for bedaquiline, with additional worldwide regulatory submissions planned. Additional research is under way in children younger than 12 years of age using a pediatric formulation of the diarylquinoline antimycobacterial drug.

The FDA in September approved Erleada (apalutamide) for treating patients with metastatic castration-sensitive prostate cancer (mCSPC). The marketing clearance follows FDA Priority Review Designation of the supplemental New Drug Application (sNDA) that was filed during April 2019 and reviewed through the regulatory agency’s Real-Time Oncology Review program. The androgen receptor inhibitor is available for the 40,000 people in the United States diagnosed with mCSPC every year. Erleada became the first treatment to gain U.S. approval for non-metastatic CRPC on Feb. 14, 2018.

The U.S. approval is based on results from the Phase III TITAN trial, the first registrational study to achieve statistical significance in dual primary endpoints of overall survival and radiographic progression-free survival in patients with mCSPC regardless of the extent of disease. Janssen reported findings during May from the Phase III TITAN study demonstrating the addition of Erleada to androgen deprivation therapy compared with placebo plus ADT significantly improved the dual primary endpoints of OS and rPFS in patients with mCSPC. The clinical trial included patients with mCSPC regardless of extent of disease or prior docetaxel treatment history.

The submission of a supplemental registration dossier to the Japanese Ministry of Health, Labour and Welfare (MHLW) for Erleada was filed on May 31 for a new indication for apalutamide as a treatment of patients with mHSPC. In June, Janssen announced a Type II variation was submitted to the European Medicines Agency seeking approval of the medicine for treating mHSPC, regardless of extent of disease or prior docetaxel treatment history.

Darzalex (daratumumab) won FDA approval in June for use in combination with lenalidomide and dexamethasone (Rd) for treating patients with newly diagnosed multiple myeloma who are ineligible for autologous stem cell transplant (ASCT). The marketing clearance is based on results from the Phase III MAIA (MMY3008) clinical trial, which demonstrated that Darzalex-Rd significantly reduced the risk of disease progression or death by 44 percent compared to treatment with Rd alone. The approval application gained clearance via the FDA’s Real-Time Oncology Review (RTOR) pilot program. The June marketing clearance marks the sixth Darzalex FDA-approved use in multiple myeloma and second for newly diagnosed patients, with the product’s first U.S. indication granted during November 2015.

A split-dosing regimen of Darzalex won FDA approval in February for multiple myeloma. The revised product label enables a new administration option for the drug as a split infusion in addition the already-approved single infusion.

Darzalex is the only CD38-directed antibody approved for treating multiple myeloma. CD38 is a surface protein present in high amounts on multiple myeloma cells, regardless of the disease stage. The medicine binds to CD38 and inhibits tumor cell growth, resulting in myeloma cell death. Darzalex may also have an effect on normal cells.

Darzalex is being studied in a comprehensive clinical development program across a range of treatment settings in multiple myeloma, including in frontline and relapsed settings. Studies are under way or planned to assess the product’s potential in other malignant and pre-malignant hematologic diseases in which CD38 is expressed, including smoldering myeloma.

The Janssen Pharmaceutical Companies announced in July the submission of a Biologics License Application to the FDA seeking approval of a new subcutaneous (SC) formulation of Darzalex, which is already available as an intravenous (IV) treatment for certain patients with multiple myeloma. The SC formulation is co-formulated with recombinant human hyaluronidase PH20 (rHuPH20), which is Halozyme’s Enhanze drug delivery technology.

Tremfya One-Press – a single-dose, patient-controlled injector for adult patients with moderate-to-severe plaque psoriasis – was cleared for approval in February. Tremfya (guselkumab) is the first FDA-approved medicine of its kind to offer the One-Press patient-controlled injector.

Top-line results were reported by Janssen in June from the Phase III DISCOVER 1 and 2 studies assessing the efficacy and safety of guselkumab compared to placebo in adults with active moderate-to-severe psoriatic arthritis (PsA). Both clinical trials met their primary endpoints of American College of Rheumatology 20 percent improvement (ACR20), and the safety profiles observed for guselkumab in the DISCOVER program were consistent with previous studies of guselkumab and Tremfya prescribing info. The DISCOVER program consists of the first-ever Phase III trials evaluating an IL-23 p19 inhibitor for psoriatic arthritis treatment.

The human monoclonal antibody Tremfya selectively blocks the p19 subunit of interleukin (IL)-23. The product is approved in the United States, Canada, European Union, Japan and other countries for the treatment of adults with moderate-to-severe plaque psoriasis who may benefit from taking injections or pills or phototherapy. Ongoing studies include: two Phase III programs evaluating Tremfya as a treatment for active psoriatic arthritis, a Phase IIb program in Crohn’s disease, and two Phase II programs – one for treating ulcerative colitis and the other for hidradenitis suppurativa.

The FDA approved Imbruvica in combination with obinutuzumab in January as the first non-chemotherapy combo regimen for treatment-naïve patients with chronic lymphocytic leukemia (CLL). The marketing clearance broadens the label in frontline CLL and represents the 10th U.S. approval for the blockbuster medicine Imbruvica. This marks the first approval for a non-chemotherapy combo regimen for treatment-naïve patients with CLL/small lymphocytic lymphoma (SLL).

The Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency (EMA) during June recommended broadening the existing marketing authorization for Imbruvica (ibrutinib) in two indications. One recommendation is for the use of ibrutinib plus obinutuzumab in adults with previously untreated CLL. The second intended indication is for use of ibrutinib plus rituximab for treating adults with Waldenström’s macroglobulinemia (WM).

Ibrutinib is approved for marketing in more than 95 countries and has been used to treat more than 140,000 patients across the medicine’s approved indications of CLL, WM and Mantle cell lymphoma (MCL). The first-in-class Bruton’s tyrosine kinase (BTK) inhibitor works by forming a strong covalent bond with BTK to block the transmission of cell survival signals within the malignant B-cells. By blocking the BTK protein, the drug decreases survival and migration of B lymphocytes, thereby delaying cancer progression.

Janssen revealed in April the filing of a New Drug Application to the FDA for the first monthly, injectable, two-drug regimen of rilpivirine and cabotegravir for the treatment of HIV. If cleared for marketing, the rilpivirine and cabotegravir regimen would be the first-ever long-acting injectable treatment for HIV-infected adults. During August, Janssen announced positive top-line results from the Phase III ATLAS-2M study of the investigational, long-acting two-drug injectable regimen rilpivirine-cabotegravir.

The study achieved the primary objective of demonstrating that administering the long-acting (LA) injectable regimen of Janssen’s rilpivirine and ViiV Healthcare’s cabotegravir every two months was as effective in maintaining viral suppression throughout the 48-week study period as monthly dosing in adults living with HIV-1 infection, whose viral load is suppressed and not resistant to rilpivirine or cabotegravir.

In other HIV vaccine news, J&J announced in July that Janssen Vaccines & Prevention B.V. and a consortium of global partners were preparing to launch the first large-scale Phase III efficacy study of the investigational mosaic-based HIV-1 preventive vaccine. Janssen’s mosaic vaccine is designed with the goal of preventing infections globally from the wide range of viral strains responsible for the HIV pandemic.

Mosaico (HPX3002/HVTN 706) will have a target enrollment of 3,800 individuals in eight countries spanning North America, South America, and Europe. The study is anticipated to launch by year-end 2019. Conducted at 55 clinical sites around the globe, the study will test Janssen’s mosaic-based HIV vaccine in men who have sex with men (MSM) and transgender people.

“Our vision at Johnson & Johnson is to develop a preventive vaccine that can be deployed anywhere, worldwide, to halt the HIV epidemic,” states Paul Stoffels, M.D., vice chairman of the Executive Committee and chief scientific officer, Johnson & Johnson. “No single organization can tackle this historic challenge alone. By working with our global partners and leveraging cutting-edge technologies, we are optimistic that we can achieve an HIV vaccine in our lifetime.”

Janssen released results in September from the Phase III OPTIMUM trial for ponesimod demonstrating superior efficacy on the primary endpoint and most secondary endpoints compared to Aubagio (teriflunomide) 14 mg in adults with relapsing multiple sclerosis (MS). In the head-to-head, two-year Phase III comparative study, statistically significant reduction of the study’s primary endpoint – annualized relapse rate (ARR) – was observed with ponesimod versus teriflunomide by 30.5 percent up to week 108. This is the first large controlled head-to-head trial comparing two oral compounds for treating relapsing MS.

This performance followed positive top-line results reported by Janssen during July from the OPTIMUM clinical trial that met primary (ARR) and most secondary endpoints. Janssen says a key secondary endpoint was change from baseline to week 108 in fatigue-related symptoms, as fatigue is considered a significant unmet need from patients’ perspective. The clinical trial also evaluated other secondary endpoints: cumulative number of combined unique active lesions (CUALs) using magnetic resonance imaging (MRI), time to first 12-week confirmed disability accumulation (CDA) and time to first 24-week CDA from baseline to end of the study.

The investigational selective S1P1 receptor modulator ponesimod functionally inhibits S1P activity and reduces the amount of circulating lymphocytes. Research indicates that in people with relapsing-remitting multiple sclerosis (RRMS), ponesimod prevents immune cells from crossing the blood-brain barrier and damaging myelin, which is a protective sheath that insulates nerve cells and is damaged in patients with multiple sclerosis.

Janssen announced significant new real-world evidence in September confirming Xarelto (rivaroxaban) reduced the risk of recurrent venous thromboembolism (VTE) – or blood clots – in patients who are morbidly obese, with effectiveness and safety similar to warfarin. Notably, patients taking the blood-clot medication had significantly reduced healthcare resource utilization (HRU) and total medical costs versus those taking warfarin. The study’s results were published in Thrombosis Research.

“This is the first large-scale, real-world study to evaluate a direct oral anticoagulant (DOAC) in morbidly obese patients with VTE, and the first to identify healthcare resource utilization and medical costs in this population,” stated Alex C. Spyropoulos, M.D., professor of medicine, The Donald and Barbara Zucker School of Medicine, Hofstra University, Northwell Health at Lenox Hill Hospital, New York. “We now know from this research that rivaroxaban is as effective and safe as dose-adjusted warfarin when treating morbidly obese patients, without the need for routine anti-Xa measurements, and with significantly lower healthcare resource utilization. Physicians should feel confident in prescribing rivaroxaban for managing VTE in this population.”

During July, Janssen reported new results from the Phase III EINSTEIN-Jr trial demonstrating pediatric patients (aged birth to 17 years) treated with Xarelto had a similar low risk of recurrent VTE and similar rates of bleeding when compared to current standard anticoagulation therapy. These results from the largest pediatric study ever conducted for VTE treatment showed that the efficacy and safety profile of the product in a pediatric population with VTE is comparable to what has been observed in previous studies of adults with VTE.

The FDA granted Breakthrough Therapy Designation in September for Janssen’s investigational prophylactic vaccine for the prevention of respiratory syncytial virus (RSV)-mediated lower respiratory tract disease in adults 60 years of age.

Older adults are among the populations at highest risk of developing RSV, which is a highly contagious, potentially life-threatening respiratory infection that affects more than 64 million people globally.

The FDA Breakthrough Therapy Designation was based on clinical data with Janssen’s prophylactic RSV senior vaccine that may show substantial improvement versus available standard of care on a clinically significant endpoint(s). As a result of the Breakthrough Therapy Designation, Janssen’s prophylactic RSV senior vaccine candidate became eligible for all associated FDA features.

The investigational prophylactic vaccine is undergoing a Phase IIb proof-of-concept study to test the safety and efficacy of the vaccine against RSV in adults aged 65 years and older.

Priority Review was granted by the U.S. regulatory agency in May for the supplemental New Drug Application (sNDA) for Invokana to reduce the risk of end-stage kidney disease, the doubling of serum creatinine, and renal or cardiovascular (CV) death in adults with type 2 diabetes (T2D) and chronic kidney disease (CKD). If approved for this new indication, Invokana would represent the first diabetes medicine for the treatment of CKD in patients with T2D.

The FDA cleared a new indication for Invokana (canagliflozin) in October 2018 to reduce the risk of major adverse CV events, including heart attack, stroke or death due to a cardiovascular cause in adults with T2D who have established CV disease. The medicine is additionally indicated to lower blood sugar in adults with T2D.

Johnson & Johnson Establishes International Consortium

As a multi-sector partnership, the New Horizons Collaborative seeks to improve and scale-up ARV therapy for children and adolescents via increased awareness and research, health systems strengthening, and improved access to HIV medicines through a donation program. Through the program Janssen provides darunavir and etravirine, including child-friendly formulations, free of charge to eligible countries with the clinical capacity and willingness to address second- and third-line pediatric HIV treatment.

Introduced during 2014, the New Horizons Collaborative includes partners Janssen, the Elizabeth Glaser Pediatric AIDS Foundation (EGPAF), Partnership for Supply Chain Management (PFSCM), Imperial Health Sciences (IHS), CIPHER-IAS, The Relevance Network Ltd., and Right to Care. Ministries of Health in SSA and those countries considered to be least developed as defined by the United Nations are invited to partner with the collaborative to improve and scale up pediatric HIV treatment and improve access to HIV medicines in their countries.

As part of J&J’s 10-year initiative to drive progress against tuberculosis, the company announced in July an international research consortium to discover and develop new TB antibiotics in collaboration with eight European academic and biotech partners. Jointly funded by Europe’s Innovative Medicines Initiative (IMI) and Janssen Pharmaceutica N.V., part of the Janssen Pharmaceutical Companies, the initiative – called RESPIRI-TB – is the first in a series of new collaborations that Johnson & Johnson is undertaking to advance TB research and development.

“Over the past half century, just two new TB medicines have been developed. To achieve the ambitious global goal of ending TB, we urgently need many more innovative therapies,” Dr. Stoffels stated. “No single company or institution holds all the answers. As we did in the case of HIV, we need to work together to advance the very best science as quickly as possible. We are proud to be a founding partner in the RESPIRI-TB consortium, and we look forward to working with our global partners to develop the necessary TB treatments of the future.”

The ultimate goal of the RESPIRI-TB collaboration is to help allow for the development of a new, more efficient combination drug regimen to cure MDR-TB, with a concentration on shortening treatment duration and minimizing the likelihood of resistance.

To this end, the partners are working to advance the discovery and early-stage development of new compounds from different drug classes that could be used – in combination with each other or with existing therapies, including Janssen’s Sirturo, which was the first novel TB medicine to be approved in more than 40 years.

The consortium includes nine research teams spanning five European countries with expertise in mycobacterial diseases and drug target investigation, and also project management.

Other consortium members include Leiden University Medical Center and the University of Leiden (Netherlands, which will serve as the project coordinator); the University of Antwerp, Belgium; Sorbonne University, France; the Medical University of Vienna, Austria; the University of Copenhagen, Denmark; Mitologics, France; and FFUND B.V., Netherlands.