Top pharma companies 2022: Still riding the COVID wave

Top pharma companies 2022: Still riding the COVID wave

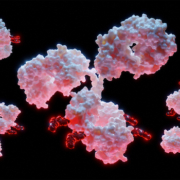

The top pharma companies in 2021 continued to be engaged in creating vaccines and therapeutics, and the investments in R&D led to greater revenue and earnings.

By Christiane Truelove • [email protected]

2021, for many of the companies profiled in this issue, was an outstanding year in several respects.

Company of the Year Pfizer Inc. certainly broke records. Comirnaty, the COVID-19 vaccine Pfizer developed with BioNTech SE, is now the best-selling drug in the world, having generated 2021 direct sales and alliance revenue of $36.78 billion for Pfizer. For the first half of 2022, that total was reported by Pfizer at $22.08 billion. With the company’s September 2022 launch of a booster aimed at the BA.4/BA.5 strain of Omicron, Pfizer anticipated $32 billion for Comirnaty for full-year 2022.

Driven by Comirnaty sales, the company reported 2021 revenue of $81.29 billion compared with $41.65 billion in 2020. Net income for 2021 was $21.98 billion compared with $9.16 billion, and diluted EPS were $3.85 compared with $1.63. First-half 2022 sales totaled $53.40 billion versus $33.42 billion in the same period last year. Net income was $17.77 billion compared with first-half 2021’s $10.44 billion. Diluted EPS were $3.66 versus $2.01.

In discussing second-quarter 2022 results, David Denton, Pfizer’s new chief financial officer and executive VP, noted strong operational revenue and earnings growth driven by multiple therapeutic areas across the company, while the COVID-19 franchises propelled the company to an all-time high in quarterly sales.

Meanwhile, the company continues to prioritize high-value uses for its capital, with an emphasis on reinvesting in the business by funding both internally and externally developed science and innovation while also continuing to grow its dividend and buy back shares, when appropriate, to help offset dilution.

“I am confident that Pfizer is well-positioned to continue to deliver exceptional value for our patients and shareholders going forward,” Denton stated.

For full-year 2022, Pfizer raised the company’s guidance, expecting revenue of $98 to $102 billion and adjusted diluted earnings per share of $6.30 to $6.45.

A Year of Performance

The challenging aspects of the ongoing pandemic aside, several of the top pharma companies also enjoyed record growth.

On Sept. 14, 2022, Johnson & Johnson announced that the board of directors had authorized the repurchase of up to $5 billion of the company’s common stock. “The last few years have demonstrated the resilience of Johnson & Johnson. With continued confidence in our business and pipeline, the board of directors and management team believe that company shares are an attractive investment opportunity,” stated CEO Joaquin Duato. “With our strong cash flow and lowest level of net debt in five years, we have the ability to invest in innovation, grow our dividend, execute strategic acquisitions, and take this action to deliver shareholder returns and drive long-term growth.”

Outside of the Covid-19 vaccine realm, Humira remained the best-selling prescription medicine in the world in 2021 with sales of $20.69 billion for AbbVie, an improvement of 4.3 percent compared with 2020.

According to company leaders, the Humira performance was primarily driven by market growth across therapeutic categories, partially offset by direct biosimilar competition in certain international markets. In the United States, Humira sales increased 8 percent in 2021 driven by market growth across all indications. This increase was partially offset by slightly lower market share following corresponding market share gains of AbbVie stable-mates Skyrizi and Rinvoq. Internationally, Humira revenue decreased 13 percent in 2021 primarily driven by direct biosimilar competition in certain international markets. In the first half of 2022, Humira sales edged up 1.7 percent to $10.1 billion.

The world’s best-selling oncologic medicine, Keytruda, generated 2021 sales of $17.19 billion for Merck & Co., an improvement of 19.5 percent over the previous year. According to the company, sales in the United States continued to build across the multiple approved indications, in particular for the treatment of advanced NSCLC as monotherapy, and in combination with chemotherapy for both nonsquamous and squamous metastatic NSCLC, along with continued uptake in the TNBC, RCC, HNSCC, MSI-H cancer, and esophageal cancer indications. Keytruda sales growth in international markets reflected continued uptake predominately for the NSCLC, HNSCC, and RCC indications, particularly in Europe. In the first half of 2022, sales of Keytruda grew 24.6 percent to $10.06 billion.

For Gilead, the company’s HIV product Biktarvy enjoyed a sales jump of 18.8 percent to $8.62 billion in 2021, solidifying its place as the best-selling HIV treatment worldwide. According to Gilead, this was due to higher demand and higher net average selling price driven by favorable changes in estimates of government rebates and discounts in the United States. In the first half of 2022, sales of Biktarvy rose 23.3 percent to $4.71 billion.

Bayer AG has started to emerge from the shadow of lawsuits over the weed killer Roundup. The company generated revenue of €44.08 billion ($52.15 billion) in 2021, 6.5 percent more than in the previous year. Net income was €1.02 billion ($1.18 billion) compared with a net loss of €10.5 billion ($12.42 billion) in 2020. Earnings per share were €1.02 ($1.21) compared with 2020’s loss per share of €10.68 ($12.63).

Acquisitions, initiatives, and spin-offs

Top pharma companies used their capital to make acquisitions in 2021 and so far in 2022. In March, AbbVie completed the acquisition of Syndesi Therapeutics SA, which management says will help to expand the company’s neuroscience portfolio. This acquisition gives AbbVie access to Syndesi’s portfolio of novel modulators of the synaptic vesicle protein 2A (SV2A), including its lead molecule SDI-118. The mechanism is being evaluated for the potential treatment of cognitive impairment and other symptoms associated with a range of neuropsychiatric and neurodegenerative disorders, such as Alzheimer’s disease and major depressive disorder. Under the terms of the agreement, AbbVie paid Syndesi shareholders a $130 million upfront payment with the potential for Syndesi shareholders to receive additional contingent payments of up to $870 million based on the achievement of certain predetermined milestones.

In September 2022, Novo Nordisk A/S and Forma Therapeutics Holdings Inc. entered into a definitive agreement under which Novo Nordisk would acquire Forma, a clinical-stage biopharmaceutical company focused on sickle cell disease (SCD) and rare blood disorders, for $1.1 billion.

Company executives say acquiring Forma Therapeutics, including the lead development candidate, etavopivat, aligns with Novo Nordisk’s strategy to complement and accelerate its scientific presence and pipeline in hemoglobinopathies, a group of disorders in which there is abnormal production or structure of the hemoglobin protein in the red blood cells.

Etavopivat, an investigational oral, once-daily, selective pyruvate kinase-R (PKR) activator, is being developed to improve anemia and red blood cell health in people with SCD, a seriously debilitating, life-threatening and life shortening disease. Etavopivat is being tested in a global Phase II/III trial (Hibiscus) in SCD patients, and in a Phase II trial (Gladiolus) in patients with transfusion-dependent SCD and another inherited hemoglobinopathy called thalassemia.

In August, Gilead agreed to acquire MiroBio, a privately held U.K.-based biotechnology company focused on restoring immune balance with agonists targeting immune inhibitory receptors, for about $405 million in cash. The acquisition, company leaders say, will provide Gilead with MiroBio’s proprietary discovery platform and entire portfolio of immune inhibitory receptor agonists. MiroBio’s lead investigational antibody, MB272, is a selective agonist of immune inhibitory receptor B- and T-Lymphocyte Attenuator (BTLA) and has entered Phase I studies. MB272 targets T, B and dendritic cells to inhibit or blunt activation and suppress an inflammatory immune response.

Management says MiroBio’s I-ReSToRE platform (REceptor Selection and Targeting to Reinstate immune Equilibrium) has the potential to be used to develop best-in-class agonist antibodies targeting immune inhibitory receptors, a novel approach to the treatment of inflammatory diseases. The I-ReSToRE platform supports identification and development of therapeutics that utilize inhibitory signaling networks with the goal of restoring immune homeostasis for patients.

Gilead anticipates advancing additional agonists derived from MiroBio’s I-ReSToRE platform, including a PD-1 agonist, MB151, and other undisclosed early-stage programs, over the next several years.

In December 2021, Sanofi agreed to acquire Amunix Pharmaceuticals Inc., an immuno-

oncology company that adds a pipeline with conditionally activated biologics. The company also agreed in December 2021 to acquire Origimm Biotechnology GmbH, a biotech company specialized in research of skin diseases.

The Amunix acquisition, which was completed in February 2022, brought the Pro-XTEN, XPAT, and XPAC technology to deliver next-generation conditionally activated biologics. Management says the technology platform is highly complementary to Sanofi’s existing R&D platforms and supports the company’s efforts to accelerate and expand its contributions to innovative medicines for oncology patients.

Amunix’s pipeline includes lead candidate AMX-818, a masked HER2-directed TCE that company executives say offers a strong strategic fit with Sanofi’s focus on developing potentially transformative cancer therapies in immuno-oncology.

Origimm adds ORI-001 to Sanofi’s early-stage pipeline. ORI-001 is a therapeutic vaccine candidate for acne vulgaris based on recombinant proteins, which entered preliminary clinical studies in third-quarter 2021. In parallel, Sanofi is working to develop additional antigen versions and expects to leverage its next-generation mRNA platform in a comprehensive Phase I/II trial to start in 2023.

Amgen Inc. struck a deal during August 2022 to acquire ChemoCentryx Inc., a biopharma company focused on orally administered therapeutics to treat autoimmune diseases, inflammatory disorders and cancer. Amgen agreed to acquire ChemoCentryx for $52 per share in cash, representing an enterprise value of $3.7 billion. The transaction was anticipated to close during the fourth quarter of 2022.

The acquisition includes Tavneos (avacopan), a first-in-class medicine for patients with serious autoimmune disease. Management said Tavneos adds to Amgen’s decades-long leadership in inflammation and nephrology.

Takeda Pharmaceutical Co. announced the exercise of its option to acquire Adaptate Biotherapeutics Ltd., a UK company focused on developing antibody-based therapeutics for the modulation of variable delta 1 (Vδ1) gamma delta (γδ) T cells. Through the acquisition, Takeda obtained Adaptate’s antibody-based γδ T cell engager platform, including pre-clinical candidate and discovery pipeline programs. Adaptate’s γδ T cell engagers are designed to specifically modulate γδ T cell-mediated immune responses at tumor sites while sparing damage to healthy cells.

GSK plc completed the acquisition of Affinivax Inc. during mid-August 2022. A clinical-stage biopharmaceutical company based in Cambridge, Mass., Affinivax has pioneered the development of a novel class of vaccines, the most advanced of which are next-generation pneumococcal vaccines.

Management stated that the acquisition of Affinivax aligns with GSK’s strategy of building a strong portfolio of specialty medicines and vaccines. The acquisition includes the next-generation 24-valent pneumococcal vaccine candidate AFX3772, which is based on the highly innovative Multiple Antigen Presenting System (MAPS) platform technology. A 30-plus valent pneumococcal candidate vaccine is additionally in preclinical development.

GSK’s acquisition of Sierra Oncology was completed on July 1, 2022. The California-based biopharmaceutical company has concentrated on targeted therapies for treating rare forms of cancer. GSK acquired all outstanding shares of Sierra Oncology for $55 per share in cash, representing a total equity value of $1.9 billion (£1.6 billion at current exchange rates). The per-share price represented a premium of 39 percent to Sierra Oncology’s closing stock price on April 12, 2022, and 63 percent to Sierra’s volume-weighted average price (VWAP) during the previous 30 trading days before the acquisition closed.

With the acquisition came the late-stage potential new medicine momelotinib, which has a unique dual mechanism of action that may address the critical unmet medical needs of myelofibrosis patients with anemia. According to management, momelotinib complements GSK’s Blenrep (belantamab mafodotin). The transaction builds on GSK’s expertise in hematology and aligns with the company’s strategy of building a strong portfolio of specialty medicines and vaccines.

In June, Bristol Myers Squibb Co. agreed to acquire Turning Point Therapeutics Inc. for $76 per share in an all-cash transaction for a total consideration of $4.1 billion in equity value. Turning Point is a clinical-stage precision oncology company with a pipeline of investigational medicines designed to target the most common mutations associated with oncogenesis. The company’s lead asset, repotrectinib, is a next-generation, potential best-in-class tyrosine kinase inhibitor (TKI) targeting the ROS1 and NTRK oncogenic drivers of non-small cell lung cancer (NSCLC) and other advanced solid tumors. Repotrectinib has been granted three Breakthrough Therapy Designations by the FDA. BMS executives expect repotrectinib to be approved in the United States in the second half of 2023. The transaction duly closed in August.

Companies profiled in this Med Ad News special edition also engaged in significant initiatives and even spin-offs to stimulate corporate growth.

Novartis AG announced in late August 2022 management’s intention to separate the generics and biosimilars division Sandoz into a new publicly traded standalone company, by way of a 100 percent spin-off. The spin-off aims to maximize shareholder value by creating the No. 1 European generics company and a worldwide leader in biosimilars, enabling Novartis shareholders to participate fully in the potential future upside for both Sandoz and Novartis Innovative Medicines.

According to Novartis Chair of the Board of Directors Joerg Reinhard, “Our strategic review examined all options for Sandoz and concluded that a 100 percent spin-off is in the best interest of shareholders. A spin-off would allow our shareholders to benefit from the potential future successes of a more focused Novartis and a standalone Sandoz, and would offer differentiated and clear investment theses for the individual businesses. Sandoz would become the publicly traded No. 1 European generics company and a global leader in biosimilars based in Switzerland.”

In September, J&J announced that the name of its new Consumer Health Company, which will become a standalone in 2023, would be Kenvue. Management says Kenvue (pronounced ken·view), is inspired by two powerful ideas: “ken” – meaning knowledge, an English word primarily used in Scotland, and “vue,” referencing sight.

“Unveiling the Kenvue brand is a defining moment for our stakeholders and an important part of the planned separation,” said Thibaut Mongon, CEO designate of Kenvue, the planned New Consumer Health Company. “We breathe life into some of the world’s most iconic and beloved brands every day, so we harnessed that same expertise, love, and energy into developing our new corporate identity.”

J&J executives say along with the name and purpose, Kenvue’s visual identity represents the company’s timelessness, while allowing space for its iconic brands to also have a home. The new logo centers on the “K” symbol, embodying the company’s strengths – the geometry of the rectangle representing scientific precision and the round edges evoking the warmth of care. The corporate name is depicted in a distinctive logotype in a rich green. This strong, distinctive color works in harmony with the multicolored palette of the company’s portfolio of well-known brands.

While not set up as a spin-off, Sanofi launched in June the company’s first Digital Accelerator to foster its ambition to become a leading digital healthcare company. Based in Paris, it brings together a team of more than 75 experts from around the world and will continue to recruit top talent in digital product management, full stack development, and data science. The Accelerator will develop products and solutions that will support Sanofi’s mission to transform the practice of medicine with the use of digital, data, and artificial intelligence.

Sanofi executives say the Digital Accelerator is first focusing on addressing unmet needs in patients suffering from atopic dermatitis in France, Italy, and Spain. The team is developing an integrated platform and data solution to better engage with healthcare professionals and enhance their awareness as well as their patients’ awareness of the disease and the available treatment options.

“Sanofi’s digital transformation is driven by a business and cultural shift as much as it is by technology,” says Arnaud Robert, executive VP and chief digital officer, Sanofi. “The Digital Accelerator will help us democratize the use of data, develop an agile mindset across the company, and accelerate innovation for patients and healthcare professionals – at speed and scale. Our investment in the Digital Accelerator is another demonstration of our commitment to transform the practice of medicine and deliver better outcomes for patients.”

Sanofi says the ongoing digital transformation has already led to significant achievements including accelerating the discovery of new targets using AI; accelerating R&D image analysis using AI, improving clinical trial efficiency by using real-world evidence to reduce the number of patients that must be enrolled and by enabling participants to provide their data and digital biomarkers remotely; and optimizing advertising and promotional spend across multiple markets and products.

By 2025, Sanofi’s digital healthcare platform is expected to support new digital businesses, fuel new digital experiences for patients and HCPs, and drive innovation and efficiencies across the entire value chain.

More than just Comirnaty

Several of the leading pharma companies have developed, or continue to develop, vaccines and therapeutics for COVID-19.

In Pfizer’s case, Comirnaty has not been the only weapon in the company’s COVID-19 arsenal. After generating $76 million in U.S. sales in December 2021 after being authorized for emergency use, Paxlovid revenue totaled $9.59 billion in the first half of 2022, driven by the company’s various supply agreements. In November 2021, Pfizer announced an agreement with the U.S. government to supply 10 million treatment courses of Paxlovid for a total purchase price of $5.3 billion.

In January 2022, the U.S. government committed to purchase an additional 10 million treatment courses of Paxlovid, bringing the total number to 20 million. About 10 million Paxlovid treatment courses were expected to be delivered to the United States by the end of June 2022, with the remaining 10 million expected to follow by the end of September 2022.

In December 2021, Pfizer announced an agreement with the United Kingdom to supply an additional 2.5 million treatment courses of Paxlovid, in addition to the 250,000 treatment courses previously contracted. A total of 2.75 million courses are expected to be delivered to the U.K. through 2022.

Also in December 2021, Pfizer announced that it planned to manufacture up to 120 million treatment courses of Paxlovid by the end of 2022, depending on the global need, which will be driven by advance purchase agreements, with 30 million courses expected to be produced in the first half of 2022 and the remaining 90 million courses expected to be produced in the second half of 2022.

Although AstraZeneca has not been able to get U.S. approval for Vaxzevria, the company’s Evusheld (tixagevimab co-packaged with cilgavimab), a long-acting antibody (LAAB) combination against the COVID-19 virus, is the first antibody therapy to have shown a high level of protection against symptomatic COVID-19 in a pre-exposure prevention setting.

Evusheld received Emergency Use Authorization (EUA) from the FDA in December 2021 for the pre-exposure prophylaxis (prevention) of COVID-19 in people with moderate-to-

severe immune compromise due to a medical condition or immunosuppressive medications and who may not mount an adequate immune response to COVID-19 vaccination, as well as those individuals for whom COVID-19 vaccination is not recommended.

In 2021, AstraZeneca agreed to supply the U.S. government with 700,000 Evusheld doses, and in January 2022 the government announced that it had agreed to purchase 500,000 additional doses.

Evusheld is also authorized for emergency use for prevention of COVID-19 in several other countries, including France.

Contracts pushed the sales of Evusheld to $914 million in the first half of 2022. The company has received contracts to provide doses in Central and Eastern Europe, Latin America, and South East Asia, and China. Evusheld is now the first non-Chinese medicine to be used for the prevention of COVID-19 in China. The drug was approved in the EU for the prevention of COVID-19 in March 2022.

In June 2022, AstraZeneca announced results from the TACKLE Phase III outpatient treatment trial, which demonstrated that Evusheld provided clinically and statistically significant protection against progression to severe COVID-19 or death from any cause compared to placebo, with treatment with Evusheld earlier in the disease course leading to more favorable outcomes. The data have been published in The Lancet Respiratory Medicine.

In September 2022, Evusheld was recommended for marketing authorization in the European Union for the treatment of adults and adolescents (aged 12 years and older weighing at least 40 kg) with COVID‑19 who do not require supplemental oxygen and who are at increased risk of progressing to severe COVID‑19.

The Committee for Medicinal Products for Human Use (CHMP) of the European Medicines Agency based its positive opinion on results from the TACKLE Phase III COVID-19 treatment trial which showed one intramuscular (IM) dose of Evusheld provided clinically and statistically significant protection against progression to severe COVID-19 or death from any cause compared to placebo. Evusheld treatment earlier in the disease course led to more favorable outcomes.

The World Health Organization (WHO) issued an updated Emergency Use Listing (EUL) for the Johnson & Johnson COVID-19 vaccine in April 2022, recommending the vaccine for use in boosted regimens in persons aged 18 years and older. According to the updated EUL, the Johnson & Johnson COVID-19 vaccine is recommend for use both as a homologous booster (same vaccine) after a single-dose primary vaccination and as a heterologous booster (‘mix-and-match’ vaccines) following a primary mRNA vaccine regimen.

The Johnson & Johnson COVID-19 vaccine booster additionally received Emergency Use Authorization from the FDA and a positive opinion from the CHMP.

J&J’s COVID-19 vaccine is made available globally via COVAX, the African Vaccine Acquisition Trust (AVAT) and other supply deals with governments, and access to the vaccine for some of the world’s most vulnerable people has been enabled through the COVAX Humanitarian Buffer.

J&J struck a deal in March 2022 to enable the first COVID-19 vaccine to be manufactured and made available by an African company for people living in Africa, with the goal of increasing COVID-19 vaccination rates across the continent.

The FDA granted priority review to Roche during April 2022 to Actemra/RoActemra (tocilizumab) for treating COVID-19 in hospitalized adults. If cleared for marketing, Actemra/RoActemra would be the first FDA-approved immunomodulator for treating COVID-19 in hospitalized patients.

Actemra/RoActemra received Emergency Use Authorization from the FDA in June 2021 and is approved for use in at least 16 countries for defined patients hospitalized with severe or critical COVID-19. WHO during February 2022 prequalified Actemra/RoActemra for patients with severe or critical COVID-19, supporting access to care in low-income and

middle-income countries.

According to management, GSK’s response to COVID-19 has been one of the broadest in the industry, with potential treatments in addition to the company’s vaccine candidates in development with partner organizations. GSK has been working with Sanofi, Medicago Inc. and SK bioscience Co. to develop adjuvanted, protein-based vaccines.

GSK is additionally exploring treatments for COVID-19 patients, collaborating with Vir Biotechnology to evaluate monoclonal antibodies that could be used as therapeutic or preventive options for COVID-19.

GSK and Vir Biotechnology announced in January 2022 a U.S. government agreement to purchase additional supply of sotrovimab, authorized for the early treatment of COVID-19. The 600,000 additional doses were supplied to the U.S. government for distribution during first-quarter 2022, allowing additional access to sotrovimab nationwide. The agreement brought the total amount of doses secured through binding agreements to 1.7 million worldwide as of January 2022. The deal included the option for the U.S. government to buy further additional doses during the second quarter of 2022.

The investigational single-dose intravenous (IV) infusion SARS-CoV-2 monoclonal antibody sotrovimab was granted an EUA by the FDA during May 2021. Under the EUA, sotrovimab can be used for treating mild-to-moderate COVID-19 in adults and pediatric patients (12 years of age and older weighing at least 40 kg) with positive results of direct SARS-CoV-2 viral testing, and who are at high risk for progression to severe COVID-19, including hospitalization or death.

GSK and Vir anticipated manufacturing 2 million doses worldwide in the 2022 first half and additional doses during the second half of the year.

The European Commission (EC) issued a marketing authorization to Xevudy (sotrovimab) for the early treatment of COVID-19 in December 2021. Sotrovimab is approved in the EU for treating adults and adolescents (aged 12 years and over and weighing at least 40kg) with COVID-19 who do not require supplemental oxygen and who are at increased risk of progressing to severe COVID-19. Sotrovimab, which incorporates Xencor’s Xtend technology, has been designed to achieve high concentration in the lungs to ensure optimal penetration into airway tissues affected by SARS-CoV-2 and to have an extended half-life.

GlaxoSmithKline is additionally working with mRNA specialist CureVac N.V. to jointly develop next-generation, optimized mRNA vaccines for COVID-19 with the potential to address multiple emerging variants within one vaccine.

GSK and Sanofi revealed positive data in June 2022 from the companies’ vaccine study which assessed an adjuvanted bivalent D614 and Beta (B.1.351) vaccine candidate. Sanofi-GSK’s vaccine is the first candidate to show efficacy in a placebo-controlled study in an environment of high Omicron variant circulation. The vaccine candidate demonstrated a favorable safety and tolerability profile.

Originally developed as a treatment for hepatitis C and later investigated in Ebola and Marburg virus, Gilead’s Veklury (remdesivir) was another failed antiviral until company researchers realized it might be effective against COVID-19. Two years and more than $10 billion in sales later, Veklury is one of the world’s leading treatments for COVID.

In January 2022, the FDA expedited approval of a supplemental new drug application for Veklury for the treatment of non-hospitalized adult and adolescent patients who are at high risk of progression to severe COVID-19, including hospitalization or death. This approval expanded the role of Veklury, which is the antiviral standard of care for the treatment of patients hospitalized with COVID-19. The expanded indication allows for Veklury to be administered in qualified outpatient settings that can administer daily intravenous infusions over three consecutive days. The FDA also expanded the pediatric Emergency Use Authorization of Veklury to include non-hospitalized pediatric patients younger than 12 years of age who are at high risk of disease progression.

In April, the FDA approved a supplemental new drug application for Veklury for the treatment of pediatric patients who are older than 28 days, weighing at least 3 kg, and are either hospitalized with COVID-19 or have mild-to-moderate COVID-19 and are considered high risk for progression to severe COVID-19, including hospitalization or death.

In June, Sanofi reported positive data from two trials conducted with its new next-generation COVID-19 booster vaccine candidate modeled on the Beta variant antigen and including GSK’s pandemic adjuvant. The data supporting this next-generation booster vaccine will be submitted to regulatory authorities and indicate the potential of Sanofi-GSK’s next-generation Beta-based booster to be a relevant response to public health needs.

“With the immunogenicity data from our Beta-booster vaccine, they support our belief that, in a largely seropositive world, a next-generation Beta booster vaccine could provide protection against variants like Omicron,” says Thomas Triomphe, executive VP, Vaccines, Sanofi. “mRNA has proven speed to market; we are demonstrating here the efficacy that our recombinant protein platform can provide to the world.”

The autoimmune product Olumiant from Eli Lilly and Co. earned $1.12 billion in sales in 2021, nearly double the previous year’s total of $639 million. This was driven in part by the use of Olumiant for the treatment of hospitalized patients with COVID-19. In the first half of 2022, sales of Olumiant rose 10 percent to $442 million. In May, the FDA approved Olumiant for the treatment of COVID-19 in hospitalized adults requiring supplemental oxygen, non-invasive or invasive mechanical ventilation, or extracorporeal membrane oxygenation with a recommended dose of 4 mg once daily for 14 days or until hospital discharge, whichever comes first. The FDA’s approval was supported by results from two randomized, double-blind, placebo-controlled Phase III studies (ACTT-2 and COV-BARRIER, including the COV-BARRIER OS 7 addendum study). Olumiant has been available in the United States under an EUA for this indication since November 2020.

During February, the FDA issued an EUA for Lilly’s bebtelovimab, an antibody that demonstrates neutralization against the Omicron variant of COVID-19. Bebtelovimab can now be used for the treatment of mild-to-moderate COVID-19 in adults and pediatric patients (12 years of age and older weighing at least 40 kg) with positive results of direct SARS-CoV-2 viral testing, and who are at high risk for progression to severe COVID-19, including hospitalization or death, and for whom alternative COVID-19 treatment options approved or authorized by the FDA are not accessible or clinically appropriate. Concurrently with the FDA’s action, Lilly announced an agreement with the U.S. government to supply up to 600,000 doses of bebtelovimab for $720 million.

Also in June, BMS announced topline results from the Phase III Accelerating COVID-19 Therapeutic Interventions and Vaccines (ACTIV-1) Immune Modulators clinical trial, sponsored by the National Institutes of Health. The study evaluated the safety and efficacy of a single dose of immune modulators, including Orencia IV (10 mg/kg) versus placebo when given with standard of care to determine if modulating the immune system’s response could speed recovery and reduce death in adults hospitalized with moderate-to-severe COVID-19.

Treatment with Orencia versus placebo displayed a strong but not statistically significant improvement in the primary endpoint of time to recovery as measured by day of hospital discharge. Analyses of the secondary endpoints, which included mortality and clinical status, demonstrated Orencia reduced participants’ risk of death and improved their clinical status at 28 days after entering the study when compared with placebo. The risk of death was lower for participants who received Orencia at 11 percent, versus 15 percent for those who received placebo, and the odds of dying were 37.4 percent lower. The relative improvement in mortality was similar in both moderately and severely ill participants. People in the Orencia group had 34.2 percent better odds of clinical improvement than those in the placebo group.

Reuters

Reuters

BioSpace

BioSpace