Top 200 Medicines Annual Report 2018: Blockbusters thriving despite tumultuous climate

There were as many billion-dollar brands in 2017 as there have been in any other calendar year despite the cratering effects of massive patent cliffs in 2012 and 2015.

Prescription blockbuster medicines flourished as well as ever in 2017, with 131 product entries exceeding the $1 billion sales barrier during last year based on Med Ad News research.

According to this year’s “Drugs to Watch” report from Clarivate Analytics, a worldwide leader in providing trusted insights and analytics to accelerate the pace of innovation, there are 12 new medicines expected to launch in 2018 that are projected to achieve annual sales of $1 billion or more by 2022. Those anticipated 12 blockbuster launch products for 2018 represent a higher total than that generated in any other year since the “Drugs to Watch” report began in 2013. The analysis used the Cortellis database, which includes data gathered from diverse sources encompassing drug pipelines, patents, clinical trials, chemistry, deals and company announcements.

“Despite political and regulatory uncertainties in the USA and EU markets, the annual Drugs to Watch report 2018 shows that the pace of pharmaceutical innovation continues to accelerate,” says Mukhtar Ahmed, president, Life Sciences at Clarivate Analytics. “2018 is on track to see many new potential game-changing drugs come to market, which will benefit the lives of millions of patients around the world.” The new medicines forecast to launch in 2018 cover a wide array of therapeutic areas such as type 2 diabetes, endometriosis, childhood epilepsy, hemophilia, HIV, migraine, opioid addiction and shingles.

GW Pharmaceuticals’ Epidiolex during June 2017 became the first-ever plant-derived cannabinoid prescription product to gain FDA regulatory approval.

Included among the 12 anticipated blockbuster launches arriving to the marketplace during 2018 are Epidiolex, the first FDA-approved cannabidiol-based drug, and Erleada, the first approved treatment option for men suffering from castration-resistant prostate cancer whose cancer has not yet spread.

GW Pharmaceuticals’ Epidiolex during June became the first-ever plant-derived cannabinoid prescription medicine to win FDA regulatory clearance. The epilepsy drug, which contains cannabidiol, is approved to treat two rare forms of childhood epilepsy: Lennox-Gastaut and Dravet syndromes in patients age 2 or older. LGS and Dravet syndrome – which develop in childhood – are rare, severe forms of epilepsy that are notoriously treatment-resistant.

The next-generation androgen receptor inhibitor Erleada (apalutamide) was granted U.S. marketing clearance in February for the treatment of patients with non-metastatic castration-resistant prostate cancer. The approval is based on Phase 3 SPARTAN clinical trial data which demonstrated that Erleada decreased the risk of distant metastasis or death by 72 percent and improved median metastasis-free survival by more than two years.

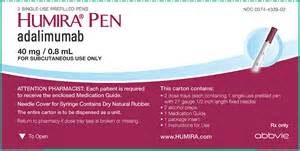

While these various new medicines work their way to blockbuster status in the years to come, Humira continues to set industry sales records. Humira’s combined sales between marketers AbbVie and Eisai reached nearly $19 billion during 2017. The anti-tumor necrosis factor biologic Humira (adalimumab) was launched in the United States during January 2003 and is indicated for multiple immunological disorders. For the first six months of 2018, AbbVie reported $9.89 billion in worldwide sales for the autoimmune biologic therapy.

The mega-blockbuster brand is expected to continue generating U.S. sales growth until 2023, at which time biosimilar sales will begin to take effect in the United States when AbbVie’s strategy to fend off rivals of the world’s No. 1 prescription drug due to various licensing deals with the likes of Samsung Bioepsis, Amgen and Mylan expire.

Meanwhile, Humira biosimilars are launching in the European Union during 2018. The biosimilars are projected to have significant uptake in the European Union since they are expected to be priced 10 percent to 20 percent lower than the originator brand across the EU. According to leading data and analytics company GlobalData, this will be further facilitated by the quotas that healthcare authorities have in place for biosimilar prescription. GlobalData analysis says one of the highest quotas are from the UK’s National Health Service (NHS), which recommends that 90 percent of new patients and 80 percent of patients currently receiving therapy be prescribed the lower-cost biologic (or biosimilar) within 12 months of the launch of a biosimilar. Lakshmi Dharmarajan, PhD, GlobalData Associate Director of Immunology, notes that, ‘‘Actual uptake does vary among different hospitals and healthcare facilities, and could in fact be lower. On average, gastroenterologists treating ulcerative colitis, anticipate prescribing the biosimilar versions to around 45% of the total adalimumab-treated population in the 5EU by 2021. … We believe that Humira biosimilars may not have as fast an uptake as Remicade biosimilars in the EU, especially for gastroenterology indications.”

AbbVie’s immune-mediated inflammatory disease treatment Humira was the world’s best-selling medication in 2017 by almost $10.76 billion more than Celgene’s No. 2-ranked oncology drug Revlimid.

Humira’s loss of U.S. patent protection in 2023 is expected to fuel the largest patent cliff the pharma industry has ever experienced in one calendar term with $67 billion of global sales at risk that year, according to EvaluatePharma’s “World Preview 2018, Outlook to 2024” report. The two most impactful years to date for worldwide sales lost to patent expiration have been 2012 ($52 billion) and 2015 ($51 billion). The report’s analysis notes that, “The growing power of payers, combined with the arguably underestimated threat of biosimilars and the genericization of some of the industry’s biggest products, including Humira are factors that could act as a brake on growth. The report shows that $251bn of sales are at risk between 2018 and 2024, teeing up a second patent cliff the industry will have to get over.”

While Humira during 2017 ranked as the top-selling medicine for the sixth consecutive calendar term with impressive year-over-year global growth of $2.42 billion, a new runner-up emerged last year: Revlimid (lenalidomide). The medicine generated 2017 sales for Celgene of almost $8.19 billion, nearly $10.76 billion behind front-runner Humira’s tally for last year. Revlimid, which won initial FDA approval in December 2005, is available for treating multiple myeloma, myelodysplastic syndromes, and mantle cell lymphoma. BeiGene during July 2017 acquired Celgene’s commercial operations in China and gained an exclusive license to commercialize Celgene’s approved therapies in that country, including Revlimid. Global sales for the oral immunomodulatory drug exceeded Revlimid’s total in 2016 by almost $1.22 billion as the medicine ranked No. 6 globally on last year’s Top 200 list. EvaluatePharma has projected worldwide sales of $11.93 billion for Revlimid in 2024, which would rank the drug No. 3 globally at that time after Humira at $15.23 billion and Merck & Co.’s anti-programmed cell death-1 (PD-1) monoclonal antibody Keytruda at $12.69 billion. Keytruda ranked No. 22 on this year’s Med Ad News’ Top 200 Medicines list with 2017 global sales of $3.81 billion for the oncology medicine.

In 2017, the TNF inhibitor therapy Remicade was the No. 3-selling prescription product worldwide for the second consecutive year.

Celgene and Revlimid made headlines in July when the Summit, N.J.-based company joined several other pharma firms in pledging to refrain from additional price increases for six months as the Trump administration enacts its drug-pricing plan. Before those several manufacturers reversed course, the president had called out Pfizer for raising drug prices in 2018. Celgene had already increased the price of Revlimid by 5 percent in 2018, and the product’s worldwide sales for the company rose 21 percent to $2.45 billion during the April-June period, constituting more than 64 percent of Celgene’s overall revenue during second-quarter 2018. For the first six months of this year, Celgene reported that Revlimid sales totaled nearly $4.69 million, an increase of 19.6 percent on a reported basis versus the one-year-earlier period. As of late July, company management projected Revlimid net sales for full-year 2018 to ~$9.7 billion compared to previous guidance of ~$9.5 billion.

During May, Celgene was reportedly one of several companies that the U.S. Food and Drug Administration previously identified as using a safety program that some pharmaceutical manufacturers have leveraged to prevent generic competition.

For the second consecutive year, the TNF inhibitor therapy Remicade was the third-highest-selling prescription medicine in the world. Marketed around the globe by Johnson & Johnson, Merck and Mitsubishi Tanabe Pharma, Remicade (infliximab) is available as a treatment for various immune-mediated inflammatory diseases. The branded biologic was launched in the United States in September 1998 and produced 2017 global sales of $7.76 billion between the three marketers, which was down by about $1.1 billion compared to Remicade’s 2016 global sales result. A biosimilar version of Remicade was introduced during 2016 in the United States, and additional competitors continue to enter the marketplace according to J&J. Lower 2017 sales were also attributed by J&J to increased discounts/rebates. The patents for the product in certain countries in Europe where Merck is the marketer expired during February 2015, and biosimilar versions have additionally been introduced in certain non-U.S. markets.

During the 2018 first half, J&J reported global Remicade sales of $2.71 billion, down 15.4 percent versus the January-June 2017 period. For Merck, the immunology medicine generated first-half 2018 sales of $324 million internationally, compared to $437 million during same-time 2017.

For a listing of the world’s top 200 medicines based on 2017 sales, please click here: Top 200 Meds 0818 PharmaLive.xlxs