What’s brewing in pharma’s new advertising mix

What’s brewing in pharma’s new advertising mix

From podcasts to traditional TV, a diversified media strategy boosts impact and reach in today’s marketing landscape.

By Sarah Caldwell

As more people become digital nomads and embrace hybrid, remote ways of working — even beyond life sciences — pharma marketers are faced with a fast-changing media landscape. Patients and healthcare providers (HCPs) are increasingly spending time across a variety of digital channels that haven’t historically been tapped into by the industry.

With audiences accessing content in new, innovative ways, how can marketers effectively nurture brand awareness and education in a world of digital choice to help consumers make informed decisions about their health? As we studied media trends for Veeva Crossix’s 2022 Health Advertising Trends Report, it quickly became clear that the key to success in maneuvering today’s fragmented media ecosystem lies in diversification.

By experimenting with new media plays across audio and streaming video while evolving the use of traditional pharma advertising channels such as linear TV, smart marketers are adapting to evolving media preferences and behaviors. With a data-driven, omnichannel approach, marketers can leverage a variety of digital touchpoints and sales calls for greater brand impact.

Tapping into emerging media channels

Since the onset of the pandemic, pharma marketers have added more connected TV, online video, and audio programming to their media mix — improving reach amongst key patients. While display still holds the lion’s share of digital reach at 80 percent of impressions, online video, streaming and audio advertisements have grown 5 percent, 18 percent and 61 percent, respectively.

Since the onset of the pandemic, pharma marketers have added more connected TV, online video, and audio programming to their media mix — improving reach amongst key patients. While display still holds the lion’s share of digital reach at 80 percent of impressions, online video, streaming and audio advertisements have grown 5 percent, 18 percent and 61 percent, respectively.

Marketers are taking advantage of the opportunity to engage patients with richer messaging across diverse touchpoints. They can use a Swiss Army knife of digital media channels to test new tactics and quickly scale campaigns that work best. Not only is this leading to greater innovation, especially in new and emerging media channels, but it’s also improving audience quality through better targeting.

For our customers investing in diverse media, we’ve seen year-over-year targeting improve more than 20 percent for digital display and online video campaigns, and 4 percent in audio. By driving greater reach for key patients and HCPs, digital is improving the overall return on marketing investments — setting the stage for how marketers will orchestrate their campaigns moving forward.

Cutting through the clutter with digital audio and video

Two emerging channels, in particular, are enabling greater precision and impact, and are likely to see exponential growth in the next few years: digital audio and video.

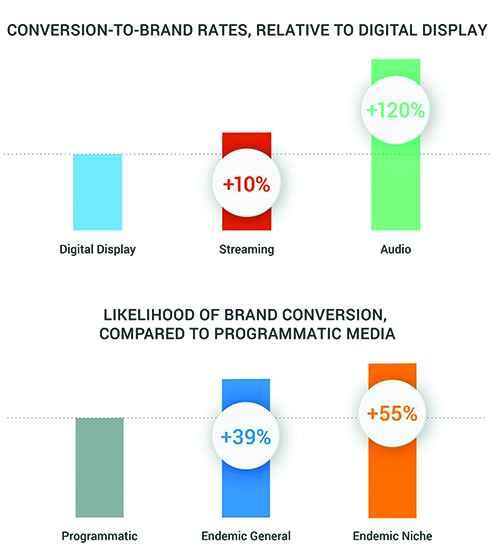

Fast becoming a player in the ongoing media mix, audio helps pharma marketers grab more of their target audience’s attention. Veeva Crossix data shows that while still a small portion of total media spend, audio positively influences patient behavior. In 2021, 50 percent more campaigns included podcasts and other emerging digital audio channels, like streaming radio. The rate of new patient starts from these tactics grew 11 percent, proving them 120 percent more effective than digital display ads.

Streaming and online video campaigns also offer precision targeting opportunities, while providing a more engaging viewing experience for consumers and HCPs. Unlike ads meant for a mass audience through linear TV, marketers can use these emerging channels to tailor richer creative to specific digital audiences.

This is especially useful as the industry moves toward more complex diseases and aims to reach niche patient populations in areas such as rare disease and oncology — where precision matters most. For example, oncology brands that aired media both on linear TV and streaming found streaming increased targeting effectiveness by 49 percent compared to linear TV buys.

To remain competitive, marketers need to test and learn what works quickly so they can optimize their approach to effectively reach patients and HCPs with the most relevant content. By layering in health-based targeting and leveraging a common measurement currency across channels and tactics, investments in and impact across these platforms can continue to grow. Ultimately, it will empower marketers to create a healthy balance of engaging content that cuts through the digital clutter.

Honing “tried-and-true” marketing tactics

As marketers continue pivoting to keep up with modern engagement preferences, many in the industry are asking themselves, “should we make the switch to streaming TV?”

Linear will continue to play a foundational role in the media mix given its reach and breadth, even as digital channels surge. It remains an effective way to deliver messages to a broad audience as well as improve their adherence to medications by reminding them to refill prescriptions. Pharma advertisers are still betting big in this space, with investments remaining eight times higher than streaming. It’s also shown to be an effective way to reach patients with common health conditions, such as diabetes.

The gap between linear and streaming will continue to shrink as streaming gains a higher share of ad investment moving forward. Each provides distinct benefits depending on marketers’ brand and campaign strategies for targeting and reaching the most relevant audiences.

Reaching key HCPs across digital channels

This complementary dynamic is also true for reaching target HCPs through programmatic and niche endemic campaigns.

In 2021, we saw 85 percent of new patient starts influenced by digital campaigns targeted to HCPs. Ads delivered through programmatic platforms will remain an important strategy in reaching a larger number of HCPs across channels, empowering marketers to continue saturating messaging against this audience.

Yet, while programmatic, audience-based targeting helps advertisers build reach and frequency across their specific prescriber groups, endemic, healthcare-specific environments still play a core role in influencing HCP behavior because these ads reach them at their point of research.

General and niche endemic environments delivered up to 55 percent higher rates of new brand starts for digital HCP campaigns compared to programmatic buys last year. Both should remain core tactics in pharma marketers’ toolkits, and data will be key to optimizing the right balance for each based on unique brand and audience goals — ultimately, meeting consumers exactly when and how they want.

The future for life sciences marketing is data-driven omnichannel

Even as digital continues to educate and influence HCPs, pharma marketers will need to focus on the dynamics between field interactions and digital media in order to establish effective omnichannel HCP engagement strategies. By delivering consistent, relevant messages through both marketing and medical and sales engagement tactics, brands can break down the barriers between these two touchpoints.

Marketers and their agencies need to have a deep understanding of each brand’s target audiences and how media behaviors are changing so they can drive the right mix of campaign tactics. Monitoring ongoing trends through data and contextualizing the market for each brand’s unique audience and media plan is key. This helps raise discussion and consideration — improving future strategies while driving more targeted impact and results.

Sarah Caldwell is general manager of Veeva Crossix Analytics.