Ad-ventures in Marketing XV

Ad-ventures in Marketing XV

For the fifteenth year, MedAdNews has chosen new Pharmaceutical Marketing Ventures to Watch that could change the way pharmaceutical products are marketed and sold.

By Joshua Slatko • [email protected]

This past October, the Med Ad News team once again began its annual search for the future of pharmaceutical marketing. We sought out young companies, spin-offs, offerings, and ventures to profile that are providing the most innovative and interesting products, services, or marketing opportunities to pharma companies and the healthcare community. This year’s three selections are a diverse lot, but they share one basic characteristic: the creative use of technology to fill a gap, whether in information available to medtech sales reps (AcuityMD), “live” advisors to help patients with questions about their care (Behavior Change eCoach), or the connection between patient visits to brand.com sites and their HCPs (HCP Trigger Data). Here are Med Ad News’ newest Pharmaceutical Marketing Ventures to Watch.

AcuityMD

AcuityMD is a platform for medtech companies and sales reps that tracks and quantifies the sales opportunities available from doctors and practices.

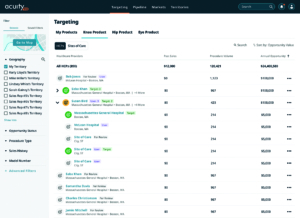

AcuityMD is a commercial platform and app for medtech companies that offers those companies’ sales reps a wealth of easily accessible data regarding potential target physicians and practices for their products. The platform ties together external market and product information with internal sales data to calculate opportunities with any given doctor or practice for medtech sales reps.

AcuityMD is the only one of our profilees this year that is a truely new venture rather than a new offering by an existing company; the company itself was launched in 2019 and signed on its first customer the following year. CEO and co-founder Michael Monovoukas explained to Med Ad News that his own journey towards AcuityMD started right after he graduated college. “I started a medical device company, had a prototype, did some basic studies around that prototype, went to tradeshows, tried to drum up interest in this new product, and I learned a lot,” he says. “I learned how difficult it was to get a brand new medical technology out to market. And I realized that there was a gap, where innovators could have really groundbreaking technology, but it’s very costly and time intensive for them to get those products out to market to benefit patients.”

So three years ago Monovoukas left his job, started raising money from investors familiar with medtech, and went into R&D for what became AcuityMD. His team began by developing what he calls a targeting platform – a tool for medical device sales and marketing organizations to quickly identify the biggest and best opportunities for their products.

“We started with the targeting platform specifically for medical device sales reps to automatically surface, prioritize, and act on new opportunities for the products they sell,” he explains. “So instead of them going out, asking people at hospitals, ‘Hey, who’s doing the most lap choles at this account?’ or, ‘Who’s doing a lot of minimally invasive surgery at this hospital?’ – instead of the sales rep prospecting manually in a really time-intensive way, Google searching or dropping by hospitals, the platform provides an automated feed of every opportunity in the market in their territory, based on the products they sell.”

Underlying this capability is a proprietary data model specific to the medical device industry. The platform is integrated with a variety of different sources such as partnerships with payers and medical claims data. “We can get visibility into where Dr. Smith did his or her knee replacements and how many knee replacements are they doing each month, each quarter, each year,” Monovoukas says. “That’s one bucket of data sources. On top of that, we’ve layered on internal data from each of these companies and transformed that internal data towards our data model as well. For example, if a company is selling knee replacements, we’ll hook into their invoice data so we can say, ‘Okay, you’re selling knee replacements. Dr. Smith does 100 knee replacements a month. You’re only selling 50 into that account, so there’s a lot of room to grow your business at that facility with that surgeon.”

As luck would have it, AcuityMD signed on its first customer in early 2020 just as the COVID-19 pandemic was starting. In the two years since, though, the company has added more than 50 medical device companies to its roster. Monovoukas recalls very clearly one early pitch of the AcuityMD prototype to a potential customer. “I’ll never forget this,” he says. “The director of sales responded by saying, ‘You know more about our doctors than we know about our doctors.’ Essentially saying, ‘Well, we sell on the doctors but we don’t have visibility on the doctors we sell into.’”

That was a critical insight. “The doctors were the ones actually physically using the products in a surgical setting, but the companies providing those products didn’t have a system of record or software platform to manage surgeon level or physician level relationships and track who’s doing which surgeries with our products and who is not. The existing systems of record that medtech companies were using – the ERP system, the CRM system – didn’t really know what to do with doctors. Is the doctor a contact? Is the doctor an account? Is the doctor an opportunity? And what do those even mean in the medical device industry?”

The reality, Monovoukas explains, is that a doctor is a doctor, and doctors come with all sorts of attributes and data elements that medtechs need to keep in mind that are different than just a contact with an email and a phone number. “They are different than an account,” he says. “They are different than an opportunity. The lightbulb moment was that there was no system of record to track surgeon and product level relationships. That’s a problem because, how do you grow if you don’t know who is using your products today and who’s not? How do you grow your business? What happens if, God forbid, you have a product recall and you actually have to get product off the shelf? Which surgeons do you alert? Who do you actually talk to to get them to stop using your product because there’s a defect in it?”

Monovoukas and his team are not unaware of the common trope that medtech companies are somehow “behind” their peers in pharma when it comes to use of sales and marketing technologies. But they see that view as a bit backwards; pharma sales reps may have more and better tools to play with, but only because the software providers and developers have plain overlooked medtech, a situation AcuityMD plans on correcting.

“A lot of folks have taken almost a pejorative framing, describing the medical technology industry as behind pharma or behind other industries,” Monovoukas told Med Ad News. “I don’t think that it’s helpful to consider an industry as behind or ahead of an adoption curve of technology versus another industry. The reality is the medical device and medical technology industry has never had a tool that was built with their own needs and use cases in mind. In pharma you have a core dataset of who uses my products or who prefers my products. You have the script data. In the medical technology industry, you don’t have that core dataset. You don’t actually know which surgeons were trained on which products and which products they’re using today and how that’s changed over time. You’re missing this underlying backbone of data to help identify who uses which products and why.”

Medtechs are substantively different in a variety of other ways as well. “They have to deal with inventory and supply chain,” Monovoukas says. “Their manufacturing systems need to be in check with FDA. There are more medical device reps than there are pharma reps in the United States. Think about that for a second. It’s a small industry but there are more sales reps. That speaks to the level of closeness that these reps need to have with surgeons to train them on new technology that they’re using on patients. It’s easy for a surgeon to write a script to a new brand. It’s much harder for a surgeon to say, ‘You know what, I’m going to switch from using this implant to that implant.’ They have to be trained. They have to have a relationship with the rep, too – they’re not just going to adopt it willy-nilly. The sales model is fundamentally different and there’s never been a purpose-built solution specific to the industry. It’s always just kind of been an afterthought for the software providers that served the pharmaceutical industry.”

With all this in mind, the present incarnation of AcuityMD offers medtech sales reps a mobile device-based interface that allows them to click through each of the products in their portfolio and see lists of opportunities quantified by revenue potential. “They see a stock rank list of surgeons for different products that are relevant to those surgeons, and if you converted Dr. Smith to use Product A, that’s a $250,000 annual opportunity that you would close,” Monovoukas explains. “So, instead of seeing procedural data at the surgeon level, they actually see revenue opportunities at the surgeon and account and product level, which informs how they get to quota, [and] how much pipeline they need to build to hit their revenue goals. That feed of opportunities updates as the market evolves, and it kind of moves each sales rep through a workflow to click in each opportunity, qualify it, get visibility into the surgeon, into the account, how many procedures they’re doing, et cetera, and then mark it as a target and then act on it in a pipeline.”

The platform includes a geographic component, so sales reps traveling from one hospital or practice to the next can see what opportunities might be lurking in between. And it also offers what Monovoukas calls the “Kevin Bacon Algorithm,” which shows relationships between doctors – “Did they go to fellowship together? Do they publish together? Are they in the same practice?” These capabilities highlight another unique element of medtech sales: the fact that users of medtech aren’t necessarily static geographically. “One surgeon might operate at three hospitals and two surgery centers,” Monovoukas explains. “So you can get a product tested and evaluated in one setting and then you can follow that surgeon to all his or her other facilities as well.”

While AcuityMD has already taken a large step towards making the lives of medtech sales reps easier, Monovoukas and his team have no intention of stopping there. “We want to build the medtech commercial flywheel,” he says. “We’re going to bring on different user types in the medtech commercial organization, a sales rep, a sales manager, a sales ops leader, a marketing leader that’s doing downstream field-based marketing, someone that’s doing upstream marketing or R&D, national account leaders in charge of contracting, we’re going to stand up modules for each of those commercial profiles in the medical device industry, with the end goal of being this flywheel, this commercial flywheel that every stakeholder that you get on the platform makes it incrementally more valuable to the next.”

What might this look like? Given that many medtechs lack a robust system of recording whom is using their products today, figuring out what new products to launch to market and how to target and segment promotion for them requires a fair amount of guesswork.

“Imagine how much simpler that decision would be if you had an easily accessible database of who uses your products today and what procedures those physicians do and where you actually have white space across those procedures,” Monovoukas says. “You can say, ‘We have a great ACL product but it looks like 20 percent of our users are also doing knee replacements, and maybe we can launch a knee replacement product and launch it with that segment of ACL surgeons who also do knee replacements.’ It connects the dots between field-level sales and these big strategic decisions that the medical device enterprise makes about which markets to play and how much to invest in R&D behind those efforts.”

The bottom line question today, of course, is whether AcuityMD is making medtech sales reps’ jobs easier. To answer that, Monovoukas offers an anecdote.

“A number of times now we’ve had reps looking to change companies contact us and say, ‘Hey, can I get a demo account to help prep for my job interviews?’ Then they use the platform in their interviews, show off the platform to the hiring manager, get hired, and that’s led to new business for us as well. How many software tools for sales reps are out there that reps are actually bringing with them from one company to the next?”

Behavior Change eCoach

Atlantis Health and UneeQ’s Behavior Change eCoach is a realistic human avatar that can respond to patient questions and concerns.

The Behavior Change eCoach is a realistic human avatar – a “digital human,” if you will – that uses a combination of AI and evidence-based behavior change techniques to help patients towards healthcare goals and respond to their questions and concerns. Created via a partnership between the behavior change specialists at Atlantis Health and the AI company UneeQ, the eCoach utilizes simulated facial expressions, voice inflections, and empathy while presenting an intuitive interface that alleviates patients’ concerns about being embarrassed or judged. The eCoach digital human can provide patients with direct access to a conversational form of AI at any time, offering an emotional connection, answering questions and responding to concerns regarding diagnosis, treatment, medications, and more. The first live implementation of the eCoach, used by a pharma company to support U.S. patients with atrial fibrillation, launched this past May.

The development of the eCoach, like so many new healthcare technologies of the past two years, was spurred by COVID.

“During the pandemic, patients of all ages and demographics had to engage digitally with their HCPs,” says Amy Parke, U.S. president of Atlantis Health. “We develop content for nurse call centers, we train the nurses. But of course those call centers have limited hours [of] when they can be accessed. So somewhere along the line we asked the question – how can we provide support 24/7 to patients from someone like a nurse, a credible source that’s not just a chatbot, something or someone they would feel comfortable engaging with?”

Given how used to digital engagement patients had become during the pandemic, something like the eCoach was a potential answer. But first Atlantis needed a little bit of luck – they needed to find a client willing to take a flyer on a new technology with no history and no data to support its efficacy.

“We didn’t know how this was going to resonate with patients because it hasn’t been done before,” Parke told Med Ad News. “But we did have one client who has always challenged us – he asks us, ‘What can we do that’s innovative? What can we do that’s different? How can we better reach patients?’ Between that and our call center experience and the growing affinity of patients for digital engagement, the idea began to grow and we started discussing with that client how it might actually be built and implemented. And he had the courage to say, ‘Let’s go for it.’”

The teams at Atlantis and UneeQ went about the creation of the eCoach along two tracks – content development and digital. “Content development was actually easier than you would think because we were able to base it on the guides that we had already developed for the call centers,” Parke says. “I just had to work through really scripting that out. The creative and digital was much harder. Especially putting a face to who this person should be. Should it be male? Should it be female? Then we did some code design. We tested it with patients, with HCPs and internal stakeholders, to see what would resonate. Does she need to have an accent? What color should her skin be? Long hair, short hair? Earrings, no earrings? Then our head of creative started just sketching it out and creating this person. And now she lives on a microsite with our AI engine behind her so she can engage with patients.”

The result? Since launching in May the eCoach has had more than 14,000 engagements with patients. “Much more than we anticipated,” Parke says. “And she really has resonated with patients. On a scale of 1 to 10, out of the gate she was about a 6.57, which was good. We didn’t know what to expect, but we were happy with that given how new a technology she was.” Meanwhile, the team has been fine-tuning the eCoach based on patient responses, making her interactions and movements more human and adding more content resources.

Like a real human, the eCoach can learn and remember. “She’ll ask you what your name is, then she’ll repeat it back to you and say, ‘Did I get that right?’ And you can come back a day or two later and she’ll remember your previous conversation. She’ll say, ‘How are you, Amy? Did you access the educational information we had spoken about?”

The inevitable question with any new audience-facing tool in pharma, of course, is, what will the regulatory people think? Parke and her team were worried about MLR approval as they developed the eCoach, but as it turned out, their worries were overblown. “I thought we were going to have more barriers because it’s a large pharma with a lot of red tape,” she says. “But because the content was based on the call guides we’d already developed and deployed, it was a smoother path than we had anticipated.”

With the experience of the first eCoach under their belt, Parke and the eCoach’s developers are enthusiastic about its potential – and others are paying attention. Parke anticipates that two U.S. clients will launch their own implementations of the eCoach in 2023-2024, with other potential launches globally. And Atlantis and UneeQ have barely scratched the surface of what might be possible with such a tool; they are already looking beyond patients to other potential healthcare audiences.

“We’ve had conversations about using it in sales training,” Parke says. “We’ve had conversations about using it to engage with HCPs. The opportunities are really limitless at this point. And it is only going to get more realistic, more knowledgeable, more able to learn and engage and have valuable and productive conversations.”

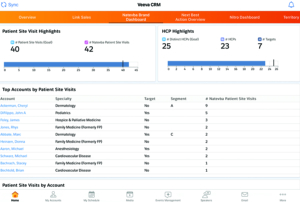

HCP Trigger Data

Veeva’s Crossix HCP Trigger Data offering, launched in May, provides a crucial link for pharma brands by tying patient visitors to brand.com to the HCPs that those patients are seeing. With the information provided by HCP Trigger Data, brands are able to identify and target HCPs who’ve already been primed by patients who may be asking about those brands – a substantial and potentially valuable crack in the usual wall between patient and HCP data and promotion, which potentially brings the patient into HCP engagement strategy to a greater degree than ever before. From a user perspective it’s pretty simple, actually: patient visits

brand.com, patient visits HCP, NPI-level HCP data delivered to brand, brand activates HCP engagement as appropriate, rinse and repeat.

“What we’re doing with HCP Triggers is making connections between patients and doctors in ways that were never done before through data,” says Sarah Caldwell, general manager, Crossix Analytics, Veeva. “Recently we’ve seen more and more of a convergence in pharma for the consumer and patient side to be connecting with the HCP and field side. In the past those two were like the separation of church and state, but now we’re seeing them come together. With HCP Trigger data we’re identifying patients who visit brand.com websites, very highly qualified patients, and connecting them with the HCPs that they are seeing, and then feeding those HCPs back to our pharma customers, so they know those HCPs are seeing highly qualified patients.”

According to Caldwell, HCP Trigger Data was very much a client-driven innovation; it grew out of a request by a Veeva customer. “We already have products around digital engagement and media that can tell our customers on the digital side, on the media side, who am I reaching from a patient perspective, how qualified are they, and what should they do post exposure? Same with brand websites. Who’s visiting my website? How qualified are they? How many of them turn into new patients starts? We do that on the patient and on the HCP side. Those solutions already existed, but they generally siloed along with the way pharma is usually structured.”

That is, until someone asked if the patient and HCP data could be combined. “One of our customers said to us, ‘Hey, it would be really great for us to understand better the DTC influence on HCPs. So, since you know who’s coming to our patient sites and then you know which HCP they see before and after, can you feed us that data?’ That was the origin of HCP Trigger Data; the client was really trying to just understand those connections. So we worked with them to take it one step further.”

In just a few months of knitting visits to brand.com and visits to HCPs together, the team at Veeva has made some interesting discoveries. “We have learned that in different therapeutic areas, that pathway from brand visit to actually getting on treatment and the number of doctor visits that happen in between varies based on condition,” Caldwell says. “For example, let’s say you’re diagnosed with diabetes and your first course of treatment is an oral diabetic drug. That might happen with your primary care doctor upon diagnosis.”

But with a condition that has a, well, “windier” patient journey, the situation is quite different. “With a specialty drug that you’re being prescribed, that time from the initial brand visit to actually getting on the drug might be 90 days and you might have three doctor visits in between,” she explains. “That’s one of the a-ha moments. We’re doing that analysis for each of our customers, so then they can say, ‘Okay, when I see that brand visit, how much time and how many visits in between might we see to have to influence that doctor? Or, if I decide to use programmatic media to reach those sectors, how much time do I have?’”

Trigger Data has also uncovered organizational insights. Bringing consumer and HCP data together, as Caldwell points out, is a substantial evolution for pharma, an evolution that can require changes in thinking and organizational structure. “The customers of ours that have been able to take this on and operationalize it are the customers that are really well-versed and able to move people through their organizations,” she says. “They’re able to get buy-in, able to overcome silos, able to get things sold into the field force and operationalized. So, you need somebody who’s a champion and can work the organization and has done that before.”

What might clients do with the data feed that HCP Trigger Data provides? “They can put this in their next best action algorithm as another data feed to the field course. They can use it to feed an immediate decision. And some of our customers are using this to then serve media to these HCPs programmatically. They can feed it into their field CRM.”

Looking to the future, Caldwell sees HCP Trigger Data speeding up. Right now the data feed is monthly – which, she notes, is about as fast as most clients can handle it. “But over time I’m sure there will be a demand to be faster, and it absolutely can be faster.” Another possibility is the exploration of additional triggers. “The visit to the consumer website is one trigger, but there are certainly others that we are exploring, just thinking about what else could trigger a channel engagement either from the patient or the HCP side.”

As with many shiny new technological innovations, though, HCP Trigger Data is still going to require a wetware upgrade from many of the humans that might be using it. “We are very much aware of how early it is for customers to use data sets like this,” Caldwell told Med Ad News. “Structures need to change, philosophies need to change. The champions of this sort of approach are going to have to navigate the silos of their organizations, really get buy-in across all the stakeholders, and we’re very aware and supportive of that during the onboarding process, helping them sell this new kind of thinking to the organization. Otherwise, it’s just more data sitting around.”

|

Josh Slatko is contributing editor of Med Ad News and PharmaLive.com. |