Johnson & Johnson accused attorneys for people who have sued the pharmaceutical giant over the company’s talc products of sharing confidential documents with Reuters in what J&J called a “calculated effort” to try its subsidiary’s bankruptcy case in the press.

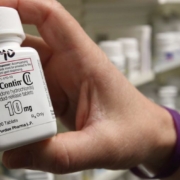

Members of the Sackler family who own Purdue Pharma LP are nearing an agreement to boost their more than $4 billion offer to resolve sprawling opioid litigation after negotiating with states that had objected to terms of the OxyContin maker’s bankruptcy reorganization, according to a court filing.

A U.S. judge on January 7 allowed Purdue Pharma to immediately challenge her rejection of legal protections for Sackler family members who own the OxyContin maker, and which were a major component of its bankruptcy reorganization plan.

Members of the Sackler family on December 6 said billions of dollars they collected from Purdue Pharma before the company filed for Chapter 11 was the result of extra cash, not part of a “secret plan” to abuse the bankruptcy system.

Facing thousands of lawsuits related to Johnson & Johnson’s talc-based products, the life sciences giant is launching a separate subsidiary dubbed LTL Management LLC that will take the brunt of potential legal liabilities.

Purdue Pharma LP said on Tuesday that creditors voted in favor of the company’s reorganization plan that would provide billions of dollars to the governments that sued the OxyContin maker for its role in the U.S. opioid crisis.

OxyContin maker Purdue Pharma pleads guilty to criminal charges

Addictions, Bankruptcy, Business, Criminal Charges, District Judges, Doctors, Former Blockbusters, Investigations, Kickbacks, New Jersey, OxyContin, Painkillers, Plea Deals, Purdue Pharma, Therapeutics, U.S. Justice Department, U.S. Opioid CrisisPurdue Pharma LP pleaded guilty to criminal charges over the handling of the company’s addictive prescription painkiller OxyContin, capping a deal with federal prosecutors to resolve an investigation into the drugmaker’s role in the U.S. opioid crisis.

The first of the Insys Therapeutics executives found guilty of violating the Racketeer Influenced and Corrupt Organizations (RICO) Act in May 2019 was sentenced to 33 months in federal prison.

A federal judge partially overturned the convictions of Insys Therapeutics Inc.’s founder and three former executives accused of bribing doctors to prescribe an addictive opioid, but declined to disturb the remainder of the jury’s verdict.

Oooooh, That’s Scary! Welcome to the Dark Side of Biopharma

Bankruptcy, Biotech, Bioterrorism, Births, Business, Carcinogens, China, CRISPR, Fraud, Gene Editing, Genes, Government, HIV, Medicare, N-nitrosodimethylamine (NDMA), Opioids, Pharma, PhRMA, Restructuring, Spinal Muscular Atrophy (SMA), StudiesFor Halloween, BioSpace collected six tales of thrills and chills from the pharma and biotech industries that will surely have you covering your eyes in terror.